“It’s the economy, stupid.” – James Carville, political analyst

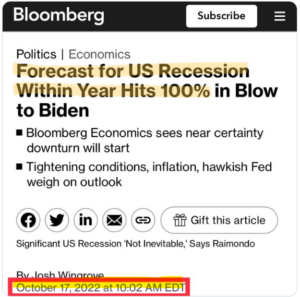

Go back to any point in 2022. You’re likely to find thousands of headlines that look like this (forget the Biden part)…

Source: Bloomberg

It was a certainty the U.S. economy was headed for a recession. Twitter called it. Bloomberg called it. Your local bartender called it.

Who can blame them? All the usual signs were there…

- Inverted yield curve

- Higher oil prices

- Higher borrowing costs

- Universal pessimism from most Americans

- Disjointed housing market

- Bank failures and rising bankruptcies

How in the heck can a consensus recession call be so wrong?

Mature Economies Tend to Be Resilient

The bigger and more complex an economy, the more resilient it tends to be.

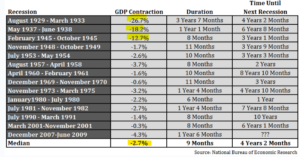

The below chart shows the economic (Gross Domestic Product or GDP) contraction for every U.S. recession from 1929 -2009.

Source: National Bureau of Economic Research (NBER)

The above chart shows GDP contraction for every U.S. recession between 1929-2009. Notice how violent and pronounced recessions were pre-WWII. These wild swings in economic activity are typical for a fragile, developing economy. Conversely, as the U.S. economy matured, recessions were much less intense. Even the Great Financial Crisis of 2007-2009 paled in comparison to the economic carnage of the Great Depression.

Everyone Predicted a Recession

If everyone expects a thunderstorm to come, they’re aware of the risks and are likely to adjust their plans. A rational person might cancel the family picnic, switch to an indoor activity, and/or reschedule for a better day.

The same works with economic plans. If everyone is expecting an economic slowdown i.e. potential job losses, higher borrowing costs, it makes sense to hunker down.

We’ve stated in the past that if everyone is talking about a recession, it becomes inherently less risky. In our opinion, true risk is what no one sees coming, for example, COVID, war, Silicon Valley Bank failure.

This is Not Normal Business Cycle

This isn’t your typical economic boom and bust. There’s no playbook for a global pandemic, supply chain disruptions, political dysfunction, war, unexpected inflation, and going from record low interest rates to decade high rates.

The fallout from the pandemic has caused unintended consequences in consumer, corporate, and government behavior. The jumbled post-COVID world has baffled the smartest economists, analysts, traders, and institutional investors.

In my opinion, they’ll be talking about this confounding period in history books for hundreds of years.

Predicting is Hard (and the recession calls have been incorrect)

Applying old rules to new problems can work, but sometimes it doesn’t. Many point to the yield curve inversion as proof we are going to get a recession. We still could get a recession, but the time tested rule of a yield curve inversion has yet to play out.

More simply still, anyone predicting recession vs. no recession is saying they can anticipate changes in human behavior. Think about that, one person in a seven billion person game, can anticipate how (sometimes) irrational and emotional humans with different objectives and incentives are going to act.

I’ll take a hard pass.

Economic activity, intertwined globally with hundreds of thousand of variables is impossible to predict. Complex systems don’t read the news or subscribe to narratives. The economy is gonna do what it’s gonna do.

No One Can Agree What a Recession Looks Like

Two quarters of negative GDP growth?

Unemployment above 5%?

The stock market down by 20+%?

The National Bureau of Economic Research official recession call?

We have made the case that the stock market is the best recession predictor. If that’s turns out to be true, we could have had a recession in the first half of 2022.

Regardless, it’s hard to have a recession if no one can agree what a recession looks like.

The US Consumer is a Juggernaut

In a previous post, “How to Solve the Inflation Problem,” we highlighted inflation was being driven by folks going out and spending like drunken sailors.

The same consumer spending phenomenon could be keeping the U.S. economy afloat.

On October 17th, 2023, retail sales numbers smashed expectations in September with no signs the U.S. consumer is slowing down (source: Yahoo! Finance).

It’s been said, “so goes the U.S. consumer, so goes the economy.” Perhaps no better words have been spoken to describe the ebbs and flows of the U.S. economy!

There you have it. That’s our best guess as to why the U.S. has dodged a recession. To be clear, we could very well get one. The impact of higher interest rates has yet to filter its way through the economy.

For more reading on recessions and markets, check out…

Assets that Could Hold Up During a Recession

Have any questions or feedback? Shoot us a note at insight@pureportfolios.com.