“If the average investor allocation to equities is abnormally high, then prices are probably abnormally high–the market’s probably expensive.” – Jesse Livermore, famous investor

Let’s go back to 2021. The U.S. economy was emerging out of its COVID slumber. Folks were getting back to regular life, going to the movies, eating out, and taking vacations.

Rates were at 0%. The government was literally dropping money into Americans bank accounts. Consumers were spending money (lots of money). The market was racing higher, seemingly everything from the S&P 500 to speculative cryptocurrency was making all-time highs.

In the middle of the ’21 euphoria, we wrote our most viral blog post, “The Best Predictor of Stock Returns is Amazingly Simple.”

“Evidence would suggest Jesse Livermore has come up with the single best predictor of stocks returns. It’s amazingly simple and you’ve probably never heard of it. Livermore’s conclusion was the higher the average investor’s equity allocation, the lower future stock returns.

Conversely, the lower the average investors’ equity allocation, the higher future stock returns. Sounds overly simplistic, but the average investor equity allocation predictor has been extremely accurate…”

It just so happens the average investor equity allocation hit cycle highs in 2021. The following year the S&P 500 was down 20%.

Fast forward to today, the Wall Street Journal ran this piece over Labor Day weekend…

Source: Wall Street Journal

The title reads, “Americans Are Really, Really Bullish on Stocks: Individuals are taking a peek at their 401k and rejoicing.” Euphoric titles like this can be contrarian signals for astute investors.

You might say, so what, markets are up and folks are feeling good about it. What’s the big deal?

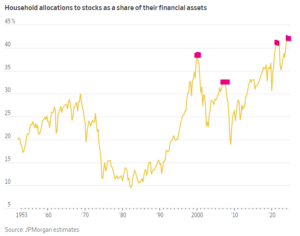

As of September 2024, the average investor equity allocation has hit a cycle high.

Source: J.P. Morgan

The above chart shows estimates for U.S. household allocation to stocks as a percentage of financial assets. Going back to 1953, cycle highs in investor’s stock allocation usually spelled trouble. The pink highlights preceded sizable market corrections in 2000, 2008, and 2021.

Does this mean stocks are due for an imminent correction? No.

Is this a powerful piece of information that is historically significant? Probably.

For kicks, we asked Pure Portfolios’ AI partner, BigData (we use BigData’s AI tool for investment research)…,

“Is average household equity allocation a good indicator of future stock returns?”

“Yes, average household equity allocation is considered a strong indicator of future stock market returns. Research has shown that higher household allocations to stocks are correlated with lower subsequent 10-year returns for the stock market.

The rationale is that when households allocate a large portion of their assets to equities, it suggests high optimism and risk-taking, which tends to coincide with market peaks. Conversely, lower household equity allocations often precede periods of stronger long-term stock market performance, as investor sentiment and risk appetite have moderated.” (source: BigData, Loyola Marymount U., American Economic Association)

In our opinion, this is another reason for paying close attention to investor sentiment/behavior.

When people are optimistic and piling into stocks, it’s probably time to exercise caution.

When people are pessimistic and shunning stocks, it’s probably time to take some risk.

Here’s some things to consider when tightening up a portfolio (we would suggest doing these things before the next market event)…

- Know what you own. We’ve seen folks with 15 different investment accounts spread across seven financial institutions. This makes basic risk management unnecessarily complex.

- Know how much risk you are taking. Do you understand the range of potential outcomes for your investments? Have you stress tested your portfolio for the worst market conditions?

- Are you diversified? A common over-allocation we see is to U.S. large cap stocks, especially big tech. These stocks have done very well, but they’ve also experienced some nasty drawdowns (look no further than 2022).

- Avoid the extremes. Good investing isn’t swinging for the fences nor is it trying to move to cash before the next crash occurs. In our opinion, good investing is generating reasonable returns over the longest period of time.

We don’t mean to sound the alarms, but we pride ourselves in thinking about all potential outcomes (see “Thinking in Probabilities”).

It would be prudent to go through the above checklist to make sure your portfolio reflects the way you feel about risk. The time to make portfolio adjustments is before the next market event happens.

As Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.”

If you would like a free portfolio review from a professional investor, shoot us a note at insight@pureportfolios.com