Much goes into crafting a detailed retirement plan. We account for income, expenses, unexpected healthcare events, annual home maintenance, travel, etc. A good plan gets down to the very last detail to make sure we are on the right track.

But what about those pesky state income taxes? Could the annual drag of state taxes derail your long-term plan?

Meet the Engleberts and the Humbertos. Both couples are 65 and newly retired. They have the same income, expenses, investable assets, and life expectancy. The only difference is the Engleberts live in Oregon and the Humbertos live in Washington state.

We wish to isolate the impact of state income taxes, hence we will ignore cost of living and other variables (property taxes, sales taxes, etc.).

Here are the annual assumptions for the Engleberts & Humbertos:

Income: Combined Social Security of $48,000 per year + monthly distribution from IRAs.

Basic Living Expenses: $65,000 increasing 2.25% per year (dropping to $45,000 per year after Mr. Englebert / Mr. Humberto pass away).

Medicare: $9,465 increasing 5.05% per year.

Home Improvement: $5,000 per year until the end of plan (~30 years).

Travel: $10,000 per year for the next 10 years.

Investable Assets: Combined $1,500,000 in Traditional IRAs invested 60% stocks/40% bonds. We will assume an annual return of 4.43% per year.

Both the Engleberts (OR) and Humbertos (WA) own their primary residence outright and have no immediate plans to relocate. Therefore, we will omit their homes from funding their retirement goals.

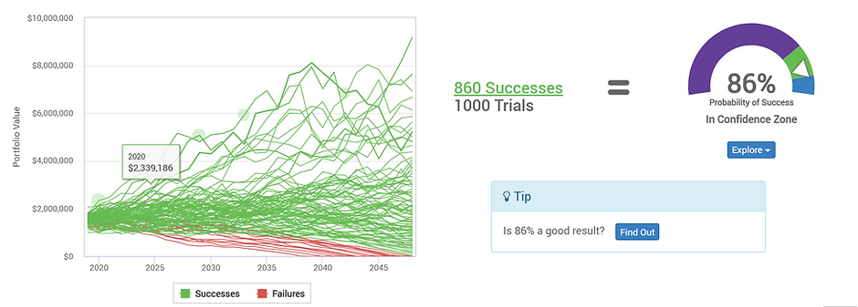

Can the Engleberts (OR) fund their retirement without running out of money?

Source: MoneyGuide Pro

The above simulation shows the Engleberts have an 86% chance of meeting their retirement goals and NOT running out of money.

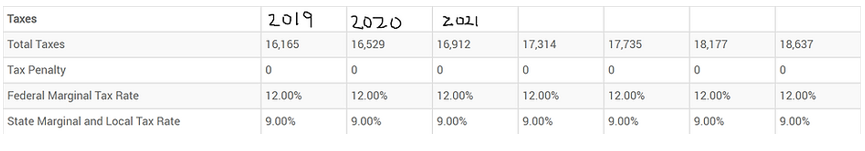

Source: MoneyGuide Pro

The above graphic shows the Engleberts total taxes paid and the combined federal & state tax rate of 21%. Looking at the IRA distributions, for every dollar the Engleberts take out, $0.09 will go to the state of Oregon.

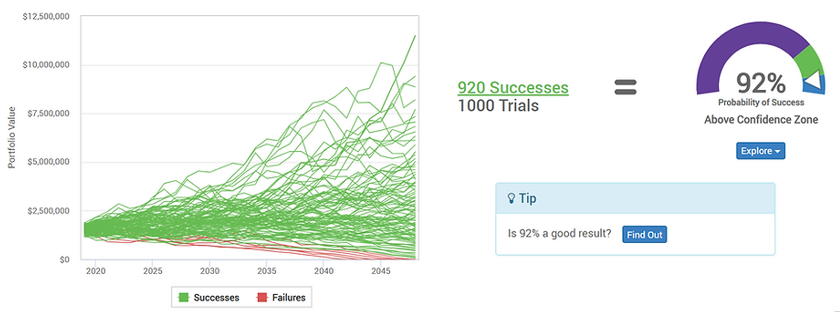

What about the Humbertos of Washington state?

Source: MoneyGuide Pro

The above simulation shows the Humbertos have a 92% chance of meeting their retirement goals and NOT running out of money. Moving to a non-income tax state boosted the Humbertos probability of success by ~6%.

If you’re feeling uneasy about retirement, we suggest putting together a detailed financial plan to account for every detail. The solution could be as easy as moving to a non-income tax or more tax friendly state.

For more information on our planning process, check out All-Time High Retirement and Better Decisions with Sound Financial Planning.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com