“When investors get negative on the market and put 50% in cash, many times it’s just about when the market is about to rally.” – Peter Lynch, famous fund manager

What do all bear markets have in common?

They quietly come to an end.

It’s hard to believe, but the washout of 2022 has given way to a new bull market.

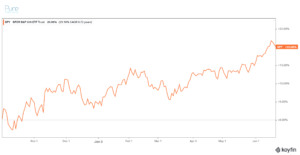

Source: Koyfin, Pure Portfolios

The above graph shows the S&P 500’s rise since the October 2022 low. Despite an avalanche of negative headlines, the market-cap weighted index entered bull market territory (20% gain from bottom) in early June 2023.

Howard Marks, co-founder of Oaktree Capital, talks how bull markets come about…

Every bull market has three stages…

- When a few far-sighted people begin to believe that some improvement is possible.

- When most investors come to agree that improvement is actually underway.

- When everyone believes everything will get better forever.

In my opinion, we are in number 1’s neighborhood. While investor sentiment has bounced off record lows, many still aren’t convinced we are out of the woods yet (to be fair, we might not be).

Our August 11, 2022 blog, “Calling Market Inflection Points,” we highlight how difficult it is to spot changes in market dynamics (for example, going from bear to bull)…

“Investors are horrid at calling inflection points in stock prices. Inflection points are large changes in market action, i.e. calling the top in stock prices or calling the bottom in stock prices.

When things are bad, we assume they will stay bad forever. When things are good, we assume prosperity will continue forever.

The reality is that things get worse quickly. Humans change their behaviors. Progress is made slowly, and eventually things get better again.”

We cover a handful of mental shortcuts to help you recognize the baton being passed from bear to bull. Note: this has nothing to do with market timing or predicting what happens next.

Avoid “Narrative” Investing

This cycle has been marred with smart-sounding narratives.

“Inflation isn’t coming down anytime soon.”

“The U.S. government is going to default and crash the market.”

“Rising interest rates are going to wreck technology stocks.”

Resist anchoring to a singular narrative. If you’re hellbent on a particular market thesis playing out, ask yourself two questions…

“What would it take to change my mind?”

“How could I be wrong?”

In investing, the ability to change one’s mind is a superpower.

The Market Doesn’t Wait

The market doesn’t wait for things to get better to bounce back. The “I’ll wait and see how things play out” seldom ends well in investing.

In fact, markets have been known to turn when conditions seem dire.

Think of economic data as looking in the rearview mirror while driving.

Think of the stock market as eyes forward scouring the path ahead, looking for hazards, and opportunities to find a better route.

The market action during the Global Financial Crisis captures this phenomenon…

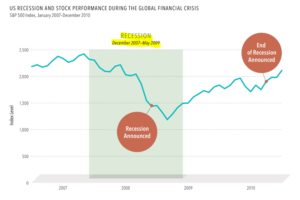

Source: Dimensional Funds

The above graphs shows S&P 500’s journey during the Global Financial Crisis (Jan. 2007 – December 2010) and the official government recession call (brown circles). The market sniffed out the pending recession before the government called it, selling off ~50% from peak to trough. In hindsight, the market called the recession perfectly (shaded gray area), while the government was late to the party with the official call. On the flip side, the market sniffed out the potential for things to get better spring of 2009, rising rapidly the remainder of the year. By the time the government got around calling the end of the recession, the market had rallied almost 100%.

The Right Thing is Rarely Comfortable

Short-term U.S. Treasury bond yields offered ~5% annualized returns spring of 2023. This was the first time investors could park idle cash and generate a meaningful return.

Many rational investors asked themselves, “why buy stocks when I can get 5% on a “risk-free” U.S. Treasury?”

That’s a fair question. However, I felt many investors were going overboard with cash.

From our May 25th, 2023 post, “How Much Cash is Too Much?“…

“Make no mistake, we encourage finding a friendly home for an emergency fund, savings account, rainy day fund, or down payment for a house, etc. This is rational behavior.

It becomes a subtle way of market timing when you’re ratholing cash with funds that would usually be invested in a long-term investment portfolio.

In investing, there’s no “all-clear” signal and the right thing is rarely comfortable.”

Since that post, the S&P 500 (SPY) is up 5.5%. TBIL. a short-term U.S. Treasury ETF, is up 0.34% (as of 6/21/23).

Sentiment is Undefeated

Markets are humans trading with other humans. In my opinion, it would be foolish to ignore investor sentiment when making allocation decisions.

It’s actually quite simple…

Allocate cash or get more aggressive when everyone is fearful.

Exercise caution when the gains are piling up and investing seems easy.

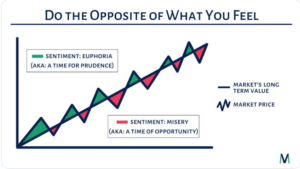

Source: Money Visualizer

The above graph is a smoothed out version of the S&P 500 (dark blue line) and investor sentiment readings (green & red). The green boxes represent investor euphoria which often precede market drops. The red boxes represent investor pessimism and often precede market rallies.

It turns out, most people would be better off doing the opposite of what they feel like doing.

This isn’t a victory lap nor do I believe we headed for uninterrupted gains.

Inflation is still too high

The Fed seems hell bent on breaking something.

The stock market rally is top-heavy.

Commercial real estate & housing could be the next shoe to drop.

I could go on…

If you’re able to evaluate markets with an objective lens, you’ll be able to recognize the baton being passed from bear to bull.

Let us know what you think about the recent market action, insight@pureportfolios.com