“Big banks, highly leveraged casinos, do whatever they can to keep the cost of their gambling as cheap as possible.” – Max Keiser, American Journalist

2022 has been a flaming dumpster fire for most asset classes.

But, there is a silver lining.

Fixed income (savings accounts, money market, CDs, bonds) finally has income!

The historical role of bonds in a diversified portfolio is to mitigate equity risk and provide investment income. When stocks go down, bonds should go up.

An investor could also count on coupon payments (interest income) for lending money to a government, municipality, or corporation.

The period following the Great Financial Crisis altered the equation. Investors could still count on the diversification benefits of bonds to offset stock market risk, but due to low interest rates, investment income was non-existent.

That’s changed.

We’re going to focus on safe places to generate a meaningful return for idle cash.

First, here is where NOT to look for income…

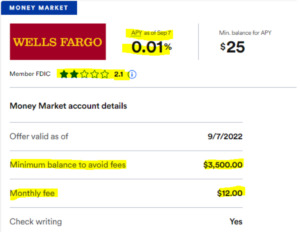

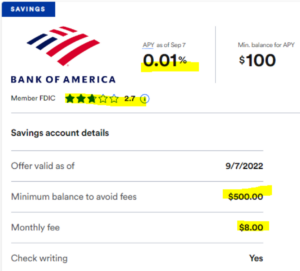

*The below rates are from Bankrate.com as of 9/7/22*

Source: Bankrate.com

Source: Bankrate.com

The above graphics show money market and savings rates for depositors of Wells and BofA. While interest rates have gone up on mortgages, car loans, personal loans, and seemingly everything else, big banks aren’t sharing the fruits with retail depositors.

Here’s where we WOULD look for income…

Series I Savings Bonds (I-Bonds)

I-Bonds can be purchased through October 2022 at the current rate of 9.62%. Interest is compounded semi-annually. For example, if you bought an I-Bond on July 1, 2022, the 9.62% rate would be applied through December 31, 2022 (source: TreasuryDirect).

What’s the catch?

The interest rate can change depending on inflation which is recalculated every six months. There is also a $10,000 limit per person for each calendar year.

For more on I-Bonds, check out the TreasuryDirect website.

Online Banks

The internet has fueled the rise of online-only banks. These are chartered, FDIC-insured banks without a physical brick & mortar presence.

If you don’t care about the lack of bank branches or personal relationships, an online bank could be an attractive place for idle cash.

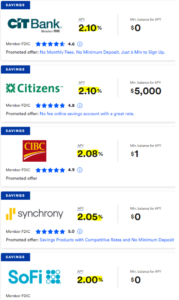

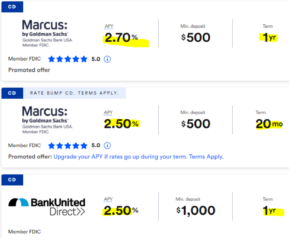

Source: Bankrate.com

The above graphics show money market and savings rates for depositors for a handful of online banks. The online bank yields and ratings are superior to those of Wall St. banks.

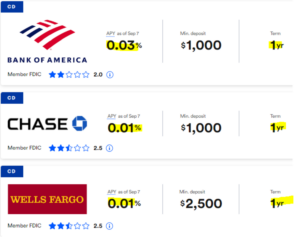

Certificates of Deposit (CD’s)

CD’s offer slightly more yield than money market or savings accounts. In return for the higher interest income, banks want to keep your money for a stated period (usually six months to one year).

Again, online banks offer superior terms vs. Wall Street banks.

Source: Bankrate.com

Source: Bankrate.com

U.S. Treasury Notes, Bills, and Bonds

When the Fed increases interest rates, the short end of the yield curve reflects the change. Savvy investors can enjoy (higher) market interest rates with no lockups, penalties, or restrictions in the most liquid bond market on the planet.

You can choose the term that fits your cash flow needs…

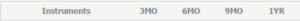

Source: Charles Schwab

The above graphic shows short-term U.S. Treasuries maturing in 3-mo, 6-mo, 9-mo, and one-year. The number represents the annualized yield-to-maturity for each bond. For example, an investor buying a one-year Treasury would achieve a total return of ~3.589% if held to maturity. Not too bad!

We’ve focused on safe places to park idle cash. A risk-seeking investor could dabble in corporate or high-yield bonds to further boost their income.

Viable options for generating reasonable income are a silver lining to an otherwise dismal year.

For more on bonds, see “Does it Still Make Sense to Own Bonds?” & “How High Can Bond Yields Go?”

If you’re curious as to how Pure Portfolios is positioning bond portfolios or generating investment income, click here.