“It’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein, former Goldman Sachs CEO

The Fed has charted the path forward for higher interest rates. Investors are worried about the impact of higher rates on economic growth, stock prices, and bond markets.

Investors are asking two important questions…

How high can bond yields go?

What does it mean for fixed income investors?

Sound familiar?

We’ve seen this movie before.

The New York Times, April 10, 2010: “Interest Rates Have Nowhere to Go but Up“

CNBC, March 15, 2011: “Interest Rates Will Rise Soon”

CNN, January 16, 2013: “Beware of the Bond Bubble in 2013”

You get the point.

We examine global yields, how U.S. bonds held up during the last tightening cycle, and why the “rising rate” narrative hasn’t come to fruition.

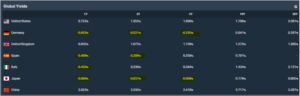

Global Yields

Source: Bespoke Investment Group

The above chart shows current yields for global bonds (as of 1/31/22). With the exception of lower quality bonds (high-yields), investment grade current yields are hovering between 1% – 2.8%.

Source: Koyfin

The above graphic shows sovereign bond yields across various maturities (top row). Not only are yields low, several bonds offer negative yields (yellow highlights).

In our opinion, it’s hard to imagine U.S. bonds decoupling from the rest of the world. If global yields remain low, that could act as a ceiling for U.S. yields. In previous writings, we noted capital flows to where it’s treated best. For example, a German investor looking to park short-term cash might find U.S. bonds attractive.

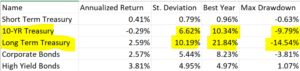

Bond Returns During Previous Hiking Cycle

The Fed funds rate was ~0% in June 2013.

June 2013, the Fed announced their intention of reducing monthly bond purchases.

October 2014, the Fed stopped buying bonds as a precursor to raising interest rates.

Here’s how various bond sub-asset classes performed from May 2013 to November 2014:

Source: Portfolio Visualizer

There was plenty of noise in longer maturity bonds, including the 10-YR Treasury. Notice the wide range of returns for Long-Term Treasuries, -21.84% to 10.19%. That’s not what you want to see in a traditionally “safe” asset class.

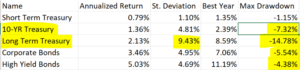

December 2015 to December 2018, the Fed increased interest rates nine times.

Here’s how the same set of bond asset classes performed from November 2015 to January 2019:

Source: Portfolio Visualizer

Despite nine interest rate hikes, every bond asset class posted a positive return. However, there was pain in longer maturity bonds (Max Drawdown column). If an investor is savvy about positioning, rising rates doesn’t have to spell doom for bonds.

We concede that bonds, interest rates, monetary policy, etc. can be confusing. Here are the takeaways…

- The Fed impacts the short end of the yield curve. Market forces, growth and inflation, influence the long end of the yield curve.

- If global bond yields remain low, it’s hard to imagine U.S. yields decoupling and rising much higher.

- Forecasting growth and inflation is extremely difficult, which makes forecasting bond yields difficult (in my opinion, the “rising rate” narrative has been the most incorrect forecast during my career).

- Examining the last tightening cycle is good for context, but doesn’t mean this cycle will follow a similar path. The pandemic has mucked up this business cycle.

- When the Fed starts to tighten monetary policy, there is often outsized volatility for longer maturity bonds.

- The Fed can pivot on a whim. They like to say data dependent, but the Fed is also market action dependent.

- Rising bond yields can be good for savers (increase in investment income), as long as your bond portfolio is flexible to changing rate environments.

For more reading on bonds, interest rates, and inflation, see:

Perspective on Rising Bond Yields

What the Treasury Market is Saying About Inflation?

Are Low Yields a Good Reason to Shun Bonds?

If you would like to learn Pure Portfolios’ approach to fixed income, click here.