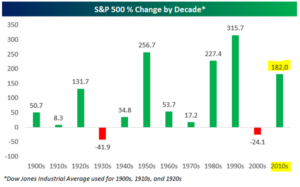

If 2000-2009 was the “lost decade” for U.S. equity markets, 2010-2019 might be dubbed the blissful Goldilocks decade. But just how good was it? In a graphic-heavy look back at the decade that was, here is what caught our attention.

Source: Bespoke Investment Group

The above graph shows the S&P 500’s % price change by decade. We were surprised that the 2010s was only the 4th best performing decade since the 1900s. Looking ahead, do U.S. investors get lower future returns (1960s/1970s), or the runaway juggernaut of the 80s and 90s?

Source: Bespoke Investment Group

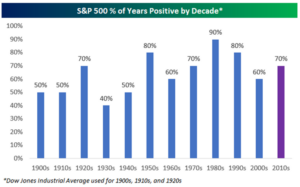

The above graph shows the S&P 500 price return was positive seven out of ten years during the 2010s. Modest negative years were posted in 2011, 2015, and 2018 (excluding dividends). Recent history has rewarded optimistic U.S. investors!

Source: Bespoke Investment Group

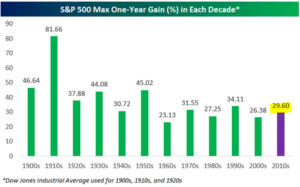

The above graph shows the S&P 500 max price gain by decade. 2013 was the best single year this decade +29.60% (barring a strong finish to 2019). The 2010s can be characterized by steady U.S. market appreciation with much lower than average volatility.

Source: Bespoke Investment Group

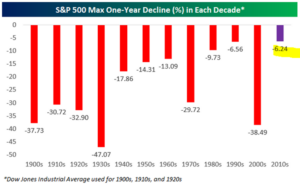

The above graph shows the worst one-year price decline for the S&P 500 (2018). Other than the 1990s, the lack of pain for U.S. investors is a bit of an outlier. The sample size is small, but notice that the lack of volatility in the 1990s led to a boatload in the 2000s (we have written about this phenomenon Stability Breeds Instability). We also notice that as the U.S. economy and markets have matured, drawdowns have become less violent (minus the 2000s).

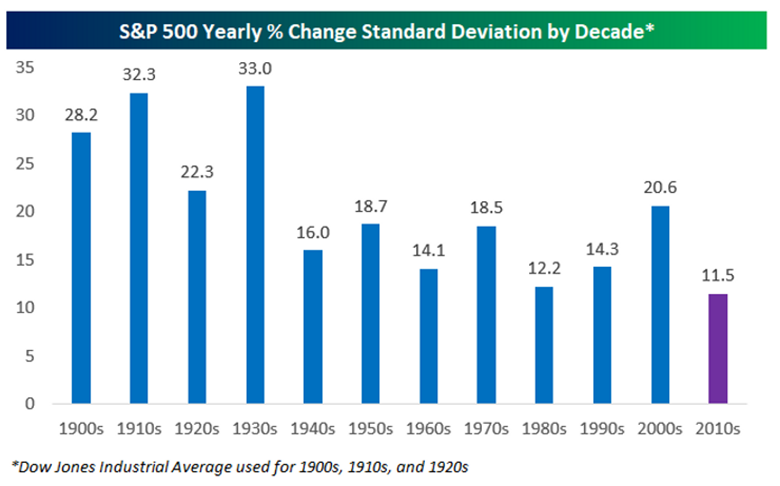

Source: Bespoke Investment Group

The above graph shows the standard deviation of annual price moves of the S&P 500 by decade. In simple terms, the 2010s were abnormally calm. Again, we can point to several periods of lower risk (1940s, 1960s, 1990s) leading to periods of higher risk. Could this relationship hold true for the 2020s?

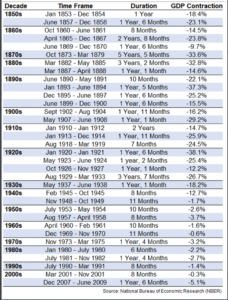

Source: National Bureau of Economic Research & Ben Carlson, CFA Wealth of Common Sense

The above graphic shows every U.S. recessionary period since 1850, including length and depth of GDP contraction. We can debate the merits of how the government calculates GDP, but in its current form the 2010s mark the first decade the U.S. has not experienced a recession. In our opinion, investors should spend less time Predicting the Next Recession and focusing more on minimizing potential damage.

We don’t know what 2020 or beyond will bring for U.S. investors, but if historical relationships hold, the next decade could be characterized by lower returns, elevated volatility, and an overdue recessionary period. Does your portfolio make the grade?