“Do not let what’s out of your control interfere with all the things you can control.” – John Wooden, legendary UCLA basketball coach.

I have a friend who is new to golf. He’s obsessed with the game (quite literally). He watches YouTube videos of the perfect golf swing. He DVRs every PGA Tour, Korn Ferry, and LPGA event. If a club manufacturer launches a new club, he’s all over it.

We recently played a casual 9-holes after work. He’s out there trying to hit cuts, draws, while talking through his game plan every shot. The commentary reminded me of the dialogue between tour pro and caddy. There is one problem, my friend is awful. There was so much going on in his head, it paralyzed his body.

I could sense his frustration mounting. I reluctantly chimed in, although I’m usually not one to share my opinion on someone else’s golf game.

Do you want some advice?

Sure.

Forget all of that crap in your head. Get the fundamentals right. Focus on gripping the club the same every time. Get lined up correctly. Adopt a pre-shot routine. Lower your expectations.

Golf is hard. Get the basic stuff right.

The same principles apply to investing.

I recently spoke to a potential client.

He was worked up over inflation. He owned a bunch of long-term bonds (which is the opposite of what you want in an inflationary environment).

He was worked up over the potential for higher capital gains taxes. He owned a bunch of mutual funds that spun off capital gains every year, saddling him with unnecessary taxes.

He was worried about a lower return environment, and was paying some advisor 1.50% per year to manage the account. The previously mentioned mutual funds added another 1% annual expense. His total cost of investing was over 2.5% per year.

We can classify investor types in many ways. I would argue that one of the most important distinctions is internal vs. external focus.

An internally focused investor obsesses about tax-efficiency, capturing the correct financial planning inputs, portfolio risk, cost, diversification, and identifying their blind spots.

We call it taking the low-hanging fruit. There’s no free lunch in investing, but we can boost our chances of a favorable outcome, whatever that looks like to you, by optimizing the things within our grasp.

An externally focused investor obsesses about today’s economic calendar. They scour news headlines looking for confirmation of their market views. They closely follow the political scene because they are convinced the other candidate will torpedo the market. They are prone to extreme views and often make large portfolio shifts depending on the recent market movements.

Rather than take easy first-downs, this investor complicates things by going off script. They are embedded in a dangerous cycle of useless information, decision fatigue, and massive cognitive and emotional biases. They want to talk financial markets 24/7 with anyone within earshot.

Here’s a quick checklist to make sure you are getting the investing basics right…

Tax-Efficiency

We’ve all heard of asset allocation, but asset location is often misunderstood. If you own several types of accounts, i.e. taxable, Roth, IRA, check out “Is Asset Location Costing You?”

You could potentially boost your net of fee return simply by optimizing where you own certain holdings.

Furthermore, your portfolio is probably not tax-efficient if you own mutual funds in non-retirement accounts, income strategies in non-retirement accounts, or have accounts across multiple advisors/financial institutions.

Capture Realistic Planning Inputs

Make sure your planning inputs reflect reality i.e. reasonable return assumptions, correct expenses, accurate tax rates, etc.

Your financial plan and portfolio should complement each other. Running your plan with an ultra conservative return assumption is a good place to start. You can ratchet up risk from there if desired.

What is your Enough? (this post is ran in the Portland Business Journal).

Better Decisions with Sound Financial Planning

Portfolio Risk & Diversification

Most investors are plugged into their portfolios’ performance, few have a sense of how much risk they are taking.

A professional advisor should be able to pull risk metrics…

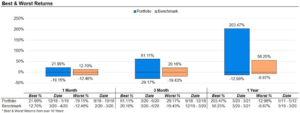

Source: Ycharts

The above shows 5-year risk metrics for a hypothetical portfolio vs. a benchmark (first graphic). The second graph shows the best & worst returns for various time periods vs. a benchmark. Risk metrics are helpful to understand the efficiency of the portfolio. The hypothetical portfolio shown is not indicative of any client portfolio.

Is Your Portfolio Drunk or Sober?

Conflicts and Cost

Do you work with a Wall Street firm?

Do you own mutual funds?

If you answer yes to either, you might be paying unnecessary fees.

We’ve found humans want advice, but you don’t have to pay a traditional suit & tie advisor 2+% per year. That’s why we we’ve created an offering that’s personalized, but at a much lower cost than most advisors (check out our unique fee schedule here).

No BS Guide to Evaluating a Financial Advisor

Your Wealth Manager Keeps Posting Record Profits (at your expense)

Need help optimizing the things you can control, but don’t know where to start? Contact us!