“Valuation changes rewarding cheap stocks and punishing expensive ones is one of the most powerfully recurring features of global equity markets.” – Dan Rasmussen, The Humble Investor

In the spring of 2023, Larry Summers, former US. Secretary of the Treasury, quipped, “Europe is a museum, Japan is a nursing home, China is a jail.”

Larry was at an investment conference touting the merits of U.S. companies, while dismissing international investment opportunities.

For the better part of the last decade, Larry Summers would have been right. U.S. stocks, fueled by the S&P 500 & technology companies, have been a runaway juggernaut posting one of the greatest stretches in history.

The positive momentum for large U.S. stocks has created a movement of investors, influencers, and experts emboldened by the “golden decade” to shun owning anything but the S&P 500.

“Why wouldn’t I own 100% of my portfolio in the S&P 500?”

I’ve been asked the above question dozens of times in the last few years. I was asked the same question exactly zero times the previous decade (see “Why Not Go All-in on the S&P 500?” and “Should I Just Buy the S&P 500 in Retirement?”).

There is a natural inertia that pulls U.S. based investors towards domestic stocks…

Home Bias

Home bias is the tendency for investors to disproportionately own domestic companies, while underweighting or shunning foreign companies.

We tend to own what we know. There’s nothing wrong with that approach, but we need to be mindful about going overboard.

According to a recent Yahoo! Finance article, about 80% of U.S. investors’ equity mutual fund investments are in domestic stocks.

S&P 500 Has Worked

Investors’ mental models tend to be simple, based on recent history, an extrapolation of trends. Positive trends will seemingly continue uninterrupted. Negative trends have no end in sight and things will likely get worse.

The tendency is overweight what just happened is a weird quirk in human psychology. What just happened is a historic decade for large U.S. companies’ stock performance. There’s a sense among the S&P 500 crowd that the next decade is going to look like the last blissful decade.

Zero Effort & Cheap

Click a button and you own 500 of the largest companies in the U.S. If you’re doing it right, there is no commission and paltry ETF expense ratios.

For example, the largest S&P 500 ETF (ticker SPY) can be purchased through every online broker for 0.09% per year.

Which brings us to 2025, foreign stocks have vastly outperformed their U.S. counterparts. Many investors are awakening and realizing the investment universe extends beyond the S&P 500.

You’ve heard popular reasons for owning foreign stocks i.e. diversification, younger demographics in emerging economies, access to unique sectors (advanced chips in Taiwan, semiconductors in South Korea), currency hedging, etc.

Here are some not-so-obvious benefits…

Markets Move in Cycles

If history is a guide, we might expect tomorrow’s winners to look different than yesterday’s winners.

In our opinion, the next 10 years won’t look the same as the previous 10 years.

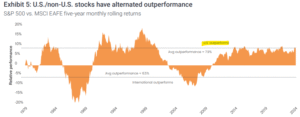

Source: Janus Henderson

The above graphic shows the S&P 500 vs. the MSCI EAFE (international index) five year rolling returns. When the orange is above the zero bound, U.S. stocks are outperforming. When the orange line is below the zero bound, foreign stocks are outperforming. Post financial crisis (2010+), the S&P 500 has been the clear winner. However, the previous decade (2000 -2009), no one was looking to go ‘all-in’ the S&P 500 as popular index saw negative returns over a 10-year period!

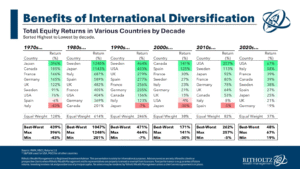

The below graph shows total equity returns for various countries by decade…

Source: Ritholtz Wealth Management

The above graph shows which countries have performed the best by decade. It’s not unusual to see yesterday’s leaders turn into tomorrow’s laggards.

Poor Setup for Large U.S. Stocks (valuation)

Many are pointing to trade uncertainty as the culprit for a rocky start for U.S. stocks. While the tariff cloud hanging over businesses doesn’t help, the margin of error for the aggressively valued S&P 500 was non-existent heading into 2025.

From our November 7th, 2024 post, “Could Future S&P 500 Returns Be Lower?”…

“We wouldn’t bet against the ingenuity of U.S. corporations, but the set up for the decade could leave investors disappointed. If history is a guide, investors could do well to downshift their return expectations for U.S. mega caps. That might mean reducing U.S. large cap concentrations, adding to other equity asset classes (small cap, value, real estate, foreign), or rebalancing.”

Despite the sell-off in U.S. stocks to start the year, U.S. companies are still technically overvalued vs. the rest of the world…

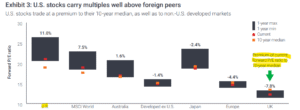

Source: Janus Henderson, Bloomberg

The above graph shows the premium or discount of forward price-to-earnings (number on top of box) to the 10-year median average (the higher the percentage, the more overvalued). While U.S. valuations have come down, they are still running 11% higher than the 10-year median level. Notice how most every other region or country is less aggressively valued or cheaper than their 10-year median valuation. Buying cheap countries and selling overpriced countries has been a pretty good strategy throughout history.

Shareholder Yield

Foreign companies currently return a greater share of earnings back to shareholders. Think dividends, stock buybacks, and paying down debt…

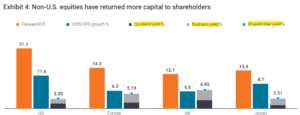

Source: Janus Henderson, LSEG DataStream, FactSet

The above graph combines valuation (orange) with what percentage of capital is returned to investors by region or country. When evaluating dividends, share buybacks, and debt paydown, foreign companies have returned a greater percentage of capital back to shareholders (gray bars).

That’s not to say investors should shun U.S. stocks. We will continue to allocate to U.S. large stocks, the S&P 500, big technology (Magnificent 7). These are highly profitable, world-class businesses. However, investors would do well to revise expectations down for U.S. stocks and sprinkle some international exposure for diversification, risk reduction, access to different markets, and potentially a superior risk/return profile for the next cycle.