“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends in a panic.” – Jim Rogers, investor

Some say the recent rally is fool’s gold.

Some say the recent rally is the start of a new up trend.

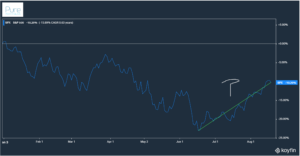

Source: Koyfin, Pure Portfolios

The above chart shows the S&P 500’s journey in 2022. Does mid-June mark the low or are we in for another drawdown?

The conundrum got us thinking….

What is the average intra-year drawdown for the S&P 500?

After experiencing a drawdown, how often does the S&P 500 finish the year higher?

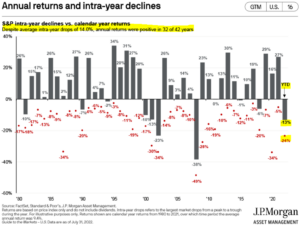

We evaluate intra-year declines and annual returns since 1980.

Source: J.P. Morgan Asset Management, FactSet, S&P

The above graph shows S&P intra-year drawdowns (red dots) vs. calendar year returns (gray bars) going back to 1980. The average intra-year drop for the S&P 500 is -14%. Amazingly, the S&P went on to finish the year in positive territory 32 out of 42 years!

In 2022, the S&P’s drawdown sits at -24%. As of this writing (8/17), the S&P is down -10.32% year-to-date.

Obviously, past performance cannot give insight into future results. However, there are some interesting trends…

- Negative intra-year returns are quite normal.

- Uninterrupted gains are abnormal.

- Investors who are patient have been rewarded.

- Modest intra-year drawdowns of -10% or less tend to finish the year positive (with the exception of 1994).

- Drawdowns over -15% tend to be a bit more mixed. Some finished the year higher, some lower.

There have been some huge intra-year swings…

1985: -8% drawdown, calendar year return of +26%

1987: -34% drawdown, calendar year return of +2%

1989: -8% drawdown, calendar year return of +27%

None of these come close to 2020. -34% drawdown, calendar year return of +16%!

What does this mean for the remainder of 2022?

No one can be sure, however…

- Just because the market takes a beating doesn’t mean you should throw in the towel.

- History has rewarded investors who haven’t panicked and lost their minds.

For more Pure content on reversals, market bottoms, and recessions, see…

Calling Market Inflection Points

Do you like our market musings? Leave us a Google Review here. It helps connect Pure Portfolios with investors who need help!