“We believe we are in a new era for fixed income in which bonds offer significantly more value.” – Vanguard on the attractiveness of fixed income

One more interest rate hike? Maybe.

Two more? Unlikely.

A pause followed by interest rate cuts? The estimates are all over the place.

Whatever your near-term outlook is for the Fed, it’s probably fair to guess they are closer to the end of their interest rate hiking cycle than the middle.

In the spirit of the Major League Baseball playoffs, it looks like the Fed is in the top or bottom of the 9th when it comes to the most aggressive hiking cycle in decades.

We’ve seen what higher interest rates have done to bond prices…

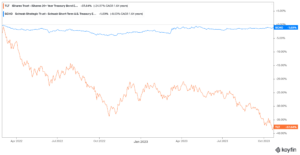

Source: Koyfin

The above chart shows 20+ year U.S. Treasury ETF (TLT, orange) and a 25+ Zero Coupon Bond ETF (ZROZ, blue). Longer maturity bonds have been decimated, resulting in the worst drawdown in ~95 years.

The damage has been done and it’s not pretty.

Let’s assume the Fed is close to a pause or pivot.

The Fed Pauses

A pause means bond yields could stay higher for longer, which is a popular narrative. In that case, investors get to enjoy interest income that hasn’t really been a thing until recently. Historically, future bond returns closely track starting yield.

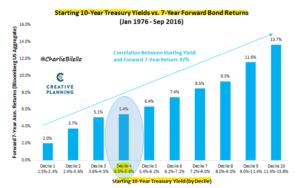

Source: Creative Planning, Charlie Bilello

The above graph shows the starting 10-year yield (bottom axis) and future annualized bond returns (vertical axis). As of this writing, the 10-year yield is in decile 4. If history holds (data set between January 1976 – 2016), future annualized bond returns could track closely to ~5%. In our opinion, this is the most attractive return set-up for bonds in over a decade.

Obviously, higher interest rates could have unintended consequences for an economy that has been used to 0% rates. From an investment standpoint, higher rates are bad for borrowers and great for savers, investors, and those looking to generate portfolio income.

The Fed Cuts Rates

The market is pricing in rate potential cuts in spring/summer of 2024.

Source: Chicago Mercantile Exchange (CME) FedWatch Tool

The above graph shows market expectations for the Fed funds rate in June 2024. As of 10/24/23, there is a better than 50% probability interest rates will be lower than the current level of 5.25% – 5.50%. The Fed can talk tough on inflation and pound the “higher for longer drum”, but the Fed cannot ignore market expectations. Keep in mind, these estimates do change over time. A few months ago, the market was pricing in cuts early 2024.

If the market is correct, what could rate cuts mean for bond prices? Here’s where “boring old bonds” could become interesting.

To fully understand the impact of rate cuts on bond prices, we need to understand duration.

According to Investopedia, duration measures the price change in a bond given a 1% change in interest rates. In general, the higher the duration, the more sensitive a bond’s price will be to changes in interest rates.

Longer maturity bonds tend to have higher duration; hence, they are more sensitive to changes in the interest rates.

Source: Koyfin

The above graph shows total returns (1/3/22 – 10/25/23) for a short-term Treasury ETF (SCHO, blue) and 20+ Year Treasury ETF (TLT). Since TLT owns longer-maturity bonds (higher duration), it is much more sensitive to rising interest rates/yields. The short-term Treasury ETF is less sensitive because the bonds mature sooner and the investor can reinvest at current, higher market rates.

The opposite is true when interest rates drop. Let’s look at the same two ETFs. For every 1% drop in interest rates, we can estimate the price movement of the bond ETFs by looking at duration.

SCHO – Short-Term Treasury ETF effective duration ~1.9. If interest rates fall by 1%, SCHO could appreciate by ~1.9%.

TLT – 20+ Year Treasury ETF effective duration ~16.27. If interest rates fall by 1%, TLT could appreciate by ~16.27%.

———————————————————————————————————————————————————————————————————

We are not advocating shoveling money into longer-maturity bonds. Look no further than the last two years, longer maturity bonds are fraught with interest rate risk.

However, some smart investors are starting to notice the value in bonds (these quotes are from Oct. 23rd, 2023)…

Bill Ackman, hedge fund manager: “We covered our bond short. There is too much risk in the world to remain short bonds at current long-term rates. The economy is slowing faster than recent data suggests.”

Bill Gross, retired co-founder of PIMCO (known as the Bond King): “Regional bank carnage and recent rise in auto delinquencies to long-term historical highs indicate U.S. economy slowing significantly. Recession in 4th quarter. On bonds. Invest in the curve. Various combinations 2/10, 2/5. Should go positive before year end. ‘Higher for longer’ is yesterday’s mantra.”

Forecasting movement in interest rates, bond yields, and inflation is hard. An investor might do well having exposure to bonds with different maturities and duration profiles.

For more on fixed income investing, check out…

Starting Yield and Future Bonds Returns

Juicy Money Market Yields Won’t Last

Have questions? Shoot us a note at insight@pureportfolios.com