“If it’s obvious, it’s obviously wrong.” – Stanley Druckenmiller, former founder of Duquesne Capital

Most investors know about the sterling performance of big technology stocks in 2023. What many forget was how out of favor the same stocks were in 2022.

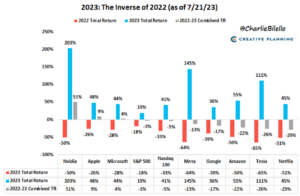

Source: Creative Planning, Charlie Bilello

The above chart shows total returns for big technology companies in 2022 (red) and 2023 (blue). Investors that stood firm in 2022 have been rewarded this year, but cumulative returns (aside from NVIDIA) are still negative or flat for the rest of big tech. The term “no pain, no gain” comes to mind. Talk about some wild year over year swings!

Big technology stocks went from outhouse to penthouse in ~7 months.

What other areas of the market are out of favor today, but could be tomorrow’s leaders?

We did a similar exercise in summer of 2022 identifying several opportunities for the enterprising investor. From “Sniffing Around for Investment Opportunities…”

“In “risk-off” markets, good companies can get hammered alongside poor companies. An investor with a long-term horizon and an iron stomach could find value at these levels. The market dislocations post-pandemic has made cash an asset. This is especially true if an investor has the willingness to deploy when market conditions are perilous.”

Let’s sniff around for the loneliest trade in financial markets. A good place to start is what the big institutional money likes & dislikes…

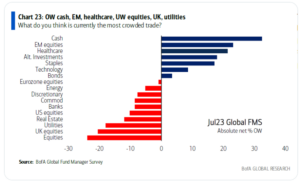

Source: Bank of America Global Research, BofA Global Fund Manager Survey

The above graph shows how ~300 institutional investors, mutual funds, and hedge fund managers are positioned across various asset classes (as of July 2023). Despite the global equity rally, professional investors (and their clients) are overallocated to cash (blue) and under allocated to equities (red).

Overweight cash and underweight equities might feel comforting, but it’s been the wrong trade.

We are reminded of Robert Arnott’s, founder of Research Affiliates, famous quote…

“In investing, what is comfortable is rarely profitable.”

At the end of 2022, it was comfortable to hold cash (especially given higher yields). It turns out most investors would have been better owning equities.

We pointed this out in our May 2023 post, “How Much Cash is Too Much?” that the clamor for cash seemed like an emotional, knee jerk decision.

“We can’t ignore the human psychology message; investors flee when it might make sense to be greedy. Investors are often greedy when they should exercise caution. It becomes a subtle way of market timing when you’re ratholing cash with funds that would usually be invested in a long-term investment portfolio.”

To invert the above Robert Arnott quote, we ask, what would be uncomfortable to own today?

Real Estate Investment Trusts (REITs)

It’s not a secret there’s trouble brewing in pockets of the real estate market. Higher borrowing costs. Lower transaction volume for the residential market. Demographic shifts (work from home) negatively impacting commercial office properties.

Where some see pain, some professional investors see a historic opportunity. From Seeking Alpha, “Billionaire Investors Have Been Rushing to Buy REITs…”

“There are some unbelievable bargains in REITs. We are already buying some stuff in the public market because I do think that rates are going down.”

Dividend Paying Stocks

There have been few losers in 2023, but dividend paying stocks fit the bill. After a decent 2022, dividend paying stocks have fallen out of favor as interest rates rise (making dividends less attractive).

Source: Koyfin

The above graph shows year-to-date performance (through 8/2/23) for the SPDR S&P Dividend ETF (orange, SDY) and the S&P 500 (blue, SPY). Big technology companies have powered the S&P 500 higher, while “boring” dividend paying stocks are less compelling when the 1-year U.S. Treasury bond yields ~5.4%.

Value Stocks

It’s a similar theme for the value factor. After a relatively stellar 2022, the shine has come off of value stocks. The banking sector’s struggles (many value indices have exposure to financials) and the AI-related tech boom haven’t helped.

The below chart highlights the performance gap between large cap value & large cap growth, but the story is the same for small and mid sized companies. Value has trailed growth across the board in 2023…

Source: Koyfin

The above graph shows year-to-date performance (through 8/2/23) for the Schwab U.S. Large Cap Value (orange, SCHV) ETF and the Schwab U.S. Large Cap Growth ETF (blue, SCHG). The valuation gap between growth vs. value has widened substantially in 2023. Could value stocks make a push the second half of the year?

This is not a proclamation that the out of favor asset classes we’ve highlighted will outperform going forward. However, good investing involves evaluating the entire opportunity available set, not simply today’s winners.

When a reporter asked Wayne Gretzky why he was always in the right place at the right time, he famously replied…

“I skate to where the puck is going to be, not where it has been.”

The same principle applies to the astute investor looking for opportunities.

Did you know 90% of Pure Portfolios clients come from other advisors (especially big Wall Street firms)? Find out why so many clients are making the switch by clicking here.