“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but aging boomers.” – Bill Gross, PIMCO founder dubbed the “Bond King”

Unloved, out of favor, beaten down.

However you want to describe it, the bond market could use some good news and a PR makeover.

Many investors have been left bruised & battered by the worst and longest bond market drawdown in recent history.

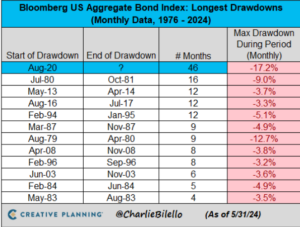

Source: Creative Planning, Charlie Bilello

The above chart shows the length and depth of historical drawdowns for the Bloomberg U.S. Aggregate Bond Index. The current drawdown began in August 2020 and continues in 2024. Are better days ahead for bond investors? We aren’t sure, but the length of the current drawdown is the longest on record, 46 months and counting, and it’s not even close.

Longer maturity debt has fared even worse. Close your eyes if you have a weak stomach…

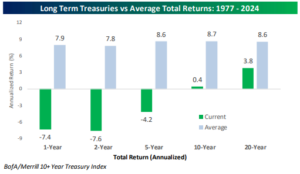

Source: Bespoke Investment Group

The above graph shows current long-term Treasury returns (green) vs. average long-term Treasury returns over various time frames. The last five years have been U-G-L-Y.

Where does the current period rank relative to history? You might say we are in the dark ages…

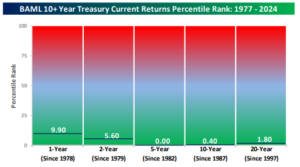

Source: Bespoke Investment Group

The above graph shows where current long-term Treasury returns rank in percentile. Again, the five-year percentile rank is the worst in history!

Why does anyone care about a confusing, opaque, and underperforming bonds?

The bond market is one of the biggest asset classes in the world representing ~ $135 trillion of debt (source: World Economic Forum, as of 2022).

Many retirees, pension funds, insurance companies, endowments, foundations, and other institutional investors own a boatload of bonds.

If you’re retired and own a multi-asset class portfolio, it’s likely bonds have been the biggest stain on your total returns over the past ~4 years.

Why was this cycle so difficult for bonds?

- We were coming off zero rates. Bond prices were sensitive to increases in interest rates & yields.

- Highest inflation in decades.

- Aggressive Fed interest rate hiking campaign (this amplified the first bullet)

- Economic dislocations due to the COVID pandemic. This wasn’t a regular business cycle.

Could the next phase of the cycle look different for bonds?

- Some experts proclaim bonds are the most attractive they’ve been in decades.

- Bond funds are capturing investor inflows (Bond funds see biggest inflows amid rate cut hopes).

- Bonds could provide stability in a recession or geopolitical event (see “Assets That Could Hold Up During a Recession“).

- Higher yields equal higher income for investors. Gone are the days of paltry bond yields. Fixed income, now has income! (see “Hey Retirees, the 4% Rule is Back“).

- Starting bond yields are historically a great precursor to future returns (see “Starting Yields and Future Bond Returns“).

Are bonds back? No.

Could higher starting yields indicate better days are ahead? We think so.