“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch, former manager of Fidelity Magellan Fund

The act of trying to time or prepare for a crash —selling out or staying sidelined — often ends up being more damaging to investors’ portfolios than the actual downturns themselves.

I call it the dog that didn’t bark.

“It looks like we are headed for a global recession.”

“How are you going to position for the recession that is coming?”

“I’m scared.”

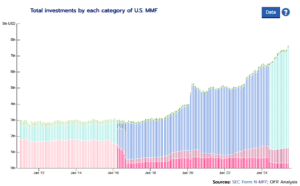

When markets get squirrely, investors clamor for the safety of cash. Many still are hunkered down from the rollercoaster ride from early 2025. Money market assets are at multi-year highs…

Source: SEC, OFR Analysis

The above chart shows total U.S. money market assets (the colors represent different types of money market funds i.e. retail, institutional, etc.). When investors are clamoring for the safety of cash, money market fund assets rise. Unfortunately, history would suggest future equity returns are quite good after money market assets peak (see “How Much Cash is Too Much Cash”).

Preparing for a stock market crash can be psychologically and financially damaging—sometimes more so than the crash itself.

Constant Fear Leads to Poor Decision-Making

The stress of anticipating a crash causes anxiety and emotional fatigue. Investors glued to news and market fluctuations may experience decision paralysis or emotional whiplash, leading to poor decision making.

Fear can prompt irrational behaviors like panic selling, over-hedging, or abandoning a sound investment plan. History shows that most long-term losses come not from the crashes themselves, but from poor investor behavior during volatile markets.

Missed Market Gains

Trying to time a crash means sitting on cash and waiting for the “all-clear” signal. In my opinion, most investors would do well to eliminate ‘wait and see’ from their investment vocabulary. By the time conditions normalize, the market has already sniffed out brighter days ahead and ascended higher (look no further than spring 2025).

Missing even a few of the best performing days in the market can drastically reduce long-term returns. According to data from J.P. Morgan, missing the 10 best days in the market over a 20-year period can cut your returns by more than half. Ironically, the best days often occur during or immediately after major downturns.

False Positives Are Expensive

Those perpetually expecting a crash may can remain underinvested for years. If the crash doesn’t come—or comes much later—they endure years of lost compound growth.

While sitting in cash might feel comforting, these decisions aren’t free. From January 2018 to June 2025, sitting entirely in cash compared to being fully invested in S&P 500 likely cost around 163% in gains, or approximately $163,000 per $100,000 invested. That makes a strong case that “playing it safe” often costs far more than enduring corrections.

As we often say, it’s okay to be bearish. It’s not okay to stay bearish.

A Crash May Not Be Catastrophic

Crashes are painful but often short-lived. The average bear market since World War II has lasted about 14 months, but recoveries tend to be faster, longer, and more robust than expected.

If you don’t want to ride the swings of a 100% stock portfolio, adding bonds, gold, or other asset classes might help an investor stomach a difficult market. Diversified, risk-aware portfolios usually don’t experience the full brunt of a market drop (see “Assets That Could Hold Up in a Recession”).

Being Uncomfortable is the Cost of Admission

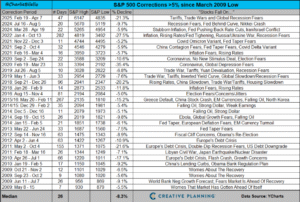

Market sell-offs are part of the deal. We can’t achieve stock market returns without the pain of occasional loss. Since March 2009, there has been 30 corrections of 5% or more…

Source: Creative Planning, YCharts

The above chart shows every S&P 500 >5% correction since March 2009. When an investor embraces the occasional drawdown or loss as normal, they can stop trying to get out of the way of the inevitable correction.

Preparation Beats Prediction (don’t listen to the “experts”)

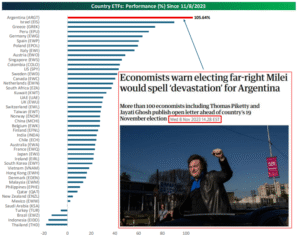

In November 2023, The Guardian published a story warning that if Javier Milei was elected President of Argentina, it would lead to financial ruin for the country. The article highlighted an open letter signed by ~100 economists backing that view.

With inflation in the country running at around 140% at the time and 40% of the country’s citizens living in poverty, it was hard to imagine how things in Argentina could get any worse, but these experts warned that it would.

Source: Bespoke Investment Group, The Guardian

The above chart shows country ETF performance since 11/8/2023. Since Javier Milei’s election, Argentinean inflation has fallen over 65% and the country boasts the world’s best performing equity market.

When 100+ experts agree, it’s usually best to run the other way (see “Turn Off the TV”).

If your advisor is making grand proclamations about what happens next and makes portfolio decisions based on “gut instinct”, you might do well to find another advisor.

———————————————————————————————————————————————————————————————————-

Preparing for a stock market crash often feels prudent, but it can be destructive. A better strategy is to build a portfolio that can weather every market environment, stay the course, and avoid the psychological and financial traps of market timing.

The dog that didn’t bark is the great destroyer of returns over the long run. Frantically scaling back risk in a portfolio every time something potentially negative looms is no way to invest.

For more reading…

Cash is NOT a Long-Term Investment Strategy

Does your advisor play the market oracle? Click here to see how we make formulaic investment decisions grounded in history rather than loose predictions based on short-term noise.