“Well, that escalated quickly.” – Ron Burgundy, Anchorman

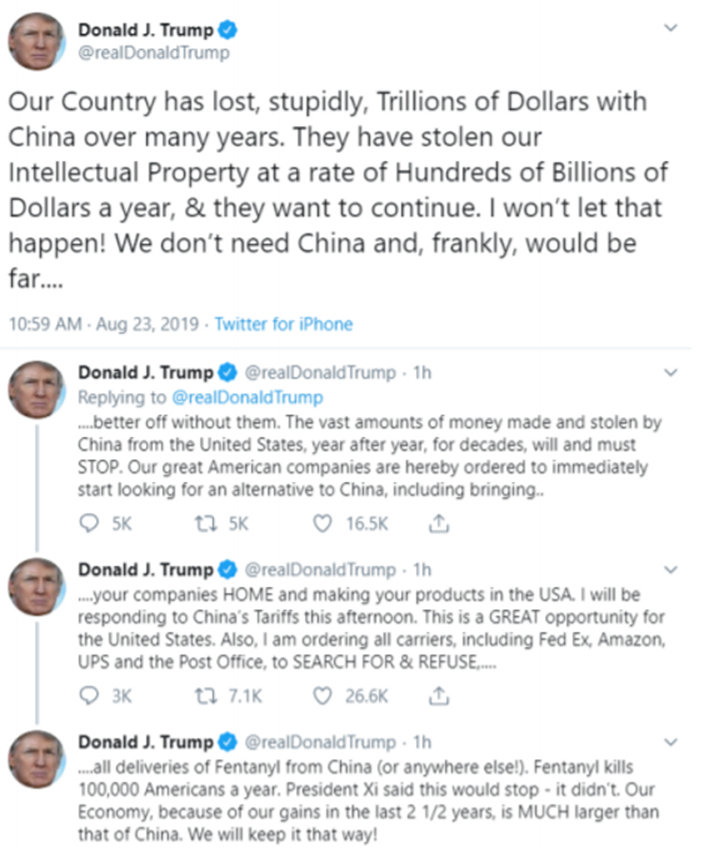

It should be obvious by now that presidential tweets are untradable, unpredictable, and financial markets are paying attention.

Last Friday’s tweetstorm was an inexpensive lesson…

Source: Twitter

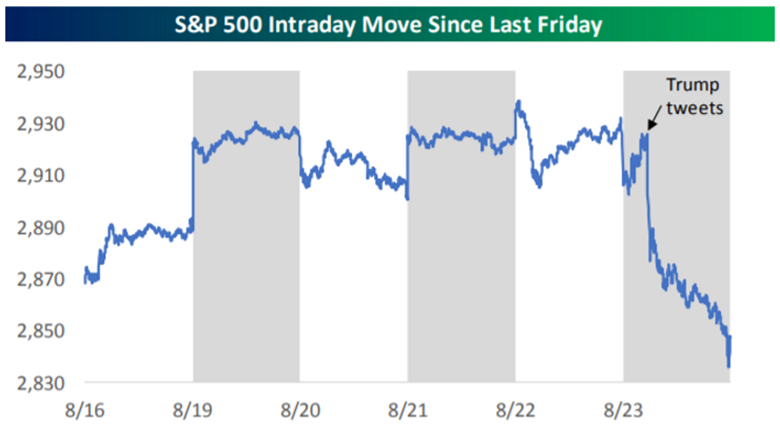

Which led to…

Source: Bespoke Investment Group

Which led to the following conversation…

New Client: The market really is taking a beating. What should we do?

Me: Nothing. We originally built the portfolio to reflect how you feel about risk. Within that framework, we are positioned conservatively with an overweight to U.S. Treasuries and Gold. The portfolio is holding up quite nicely.

New Client: Oh, that’s good.

(Pause)….

So what are we going to do?

Me: (Silence).

Should we make portfolio changes on large down days?

Nope.

Humans find comfort in action. In reality, such behavior is reactive, emotional, and destructive. Unfortunately, many investors have been conditioned to act after a market pullback.

An investor doesn’t make tweaks or adjustments after a huge market sell-off. The work was done yesterday.

Build a portfolio that reflects the way you feel about risk. Within that framework, you can adjust risk up or down by adding or selling equities. For example, a Pure Portfolios client with a 50% stocks / 50% bonds target allocation might be shaded 40% stocks / 60% bonds right now (conservative tilt). By working within a framework, we avoid making large allocation changes like moving from 50/50 to 100% cash and back again based on short-term headline risk.

We have linked previous blogs to help tighten up your financial house:

Be honest with yourself. Are you prepared to lose 10%, 20%, or 30%?.

Understand where the risk lurks in your portfolio. The bond fund you think is safe might be filled with landmines.

Listen to your financial plan. Your portfolio should complement your lifestyle.

Have a long-term investment plan or framework. Stick to it.

Don’t listen to unqualified or biased opinions. Create good information filters or seek the advice of a professional.

Identify your blind spots. Everyone is a genius during an up-market. How will you react during a prolonged market decline?

Map out the worst possible financial outcome. In other words, plan for the ugly.

Have a plan to manage risk. Buy and hold is great during good times. It’s disastrous during bad times.

Understand your investment journey. We obsess about “naked performance“, but it’s only half of the equation. Do you understand how you got there?

Boring can be good. Don’t get caught up in chasing returns or squeezing every last drop of performance. The time to get more aggressive is when it feels the worst (think 2008-2009).

If you’re constantly adjusting, tweaking, or reacting to market swings you’re setting up for a big disappointment. What you’ve built is too important. The time to do something is today.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com