The traditional high-fee

advisor is a thing of the past.

It's time for a modern approach to wealth

management. We offer a low-fee, personalized

service for investing & planning.

This is personal

Pure Portfolios is a fiduciary. Placing client interests

first isn’t a question; it is our standard.

If you’re tired of large profit-seeking investment managers, banks, brokers, and traditional financial advisors who don't prioritize you, you have come to the right place.

What we offer

We believe a well-rounded partnership doesn't start and end with portfolio management. Our financial plans are a collaborative reflection of your life’s work.

Investing

We use the latest technology to create a personalized strategy that will help manage risk, mitigate human bias, and boost tax-efficiency. We call it evidence-based investing.

Planning

Money is emotional, but your planning decisions shouldn’t be. From estate planning to stock options, Social Security, health care, employer benefits, tax planning, and more, we will help you make data-backed money decisions.

What are Pure Portfolios’ fees?

We believe the “all-in” cost of investment management

is too high. We are here to shake things up.

Management Fee |

0.65% |

Average ETF Expense |

0.10% |

All-In Cost of Investing |

0.75% |

*for qualified investors with $1M+, custom portfolios with individual stocks and bonds are available starting at 0.70%.

Our aim is to provide low-fee advice, delivered by humans. We do this by in-sourcing the investment management. We do not allocate client assets to expensive third-party managers, mutual funds, or hedge funds.

We believe an advisor’s fee structure should encourage transparency and accountability. For qualified investors, we align our management fees with investment performance, creating a clear line between our compensation and a client’s investment outcome.

Approaching retirement

Chuck and Abigail didn't know how they were invested or how much risk they were taking. Not understanding their investments heading into retirement made them uncomfortable.

Retired

Rocky and Diane didn't know the most tax-efficient way to take money out of their portfolios. They needed help deciding when to take Social Security.

Wealth building

As Elliot moves his way up the corporate ladder, he wants to better understand his stock option compensation. He is looking to break away from a traditional, high-cost Wall Street advisor and receive less conflicted advice.

Cut through the B.S.

Unfiltered commentary. Simple language.

Actionable steps.

From the latest market trends to planning tips, our weekly newsletter includes podcasts, writings, and educational videos that provide a clear-cut, unbiased outlook to help you make better money decisions.

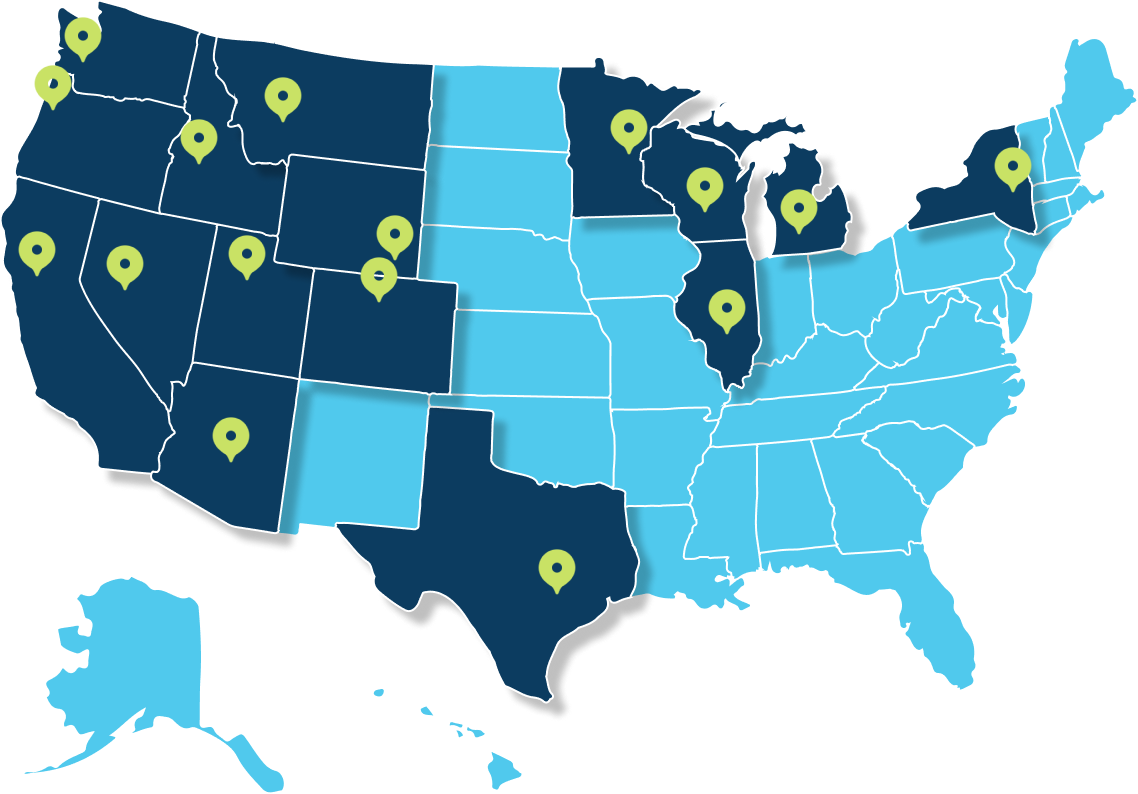

About Pure Portfolios

Tired of your conflicted, high-cost advisor? There is a better way.

We created an offering that fills the gap between the cookie-cutter service of a robo-advisor and the high-cost traditional advisor. If you want advice but don’t want to pay a premium, you’ve come to the right place.

Client experiences

This isn't a hobby. We obsess about client outcomes

Lisa Lisalinnenkohl28/01/2023

Explore the next steps

Simplify your finances and solidify a plan that gets you where

you want to go.

Step 1

Investing

Consolidate your investments with a portfolio that mirrors the way you feel about risk

Step 2

Planning

Construct a financial plan that can withstand life's surprises

Step 3

Taxes

Everyone must pay taxes, but no one says you have to leave a tip. We ensure your portfolio and financial plan are tax efficient

Sunday Coffee Reads

4576 Weeks to Live

“Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You...

Read More

The World’s Worst Investor

“Humans have something weird in their DNA which prohibits them from adopting good ideas easily.” – William Green, Richer, Wiser, Happier Sally is a nervous...

Read More

A Simple Case for Gold and Bitcoin

“The debt is not going to be balanced. The annual deficit seems to be getting worse and worse. And if the dollar is going to...

Read More

Recession Signals that are Flashing Red

“There are decades when nothing happens, and weeks when decades happen.” – Uday Kotak, founder of Kotak Mahindra Bank The gap between how people are...

Read More

International Diversification: Looking Beyond the S&P 500

“Valuation changes rewarding cheap stocks and punishing expensive ones is one of the most powerfully recurring features of global equity markets.” – Dan Rasmussen, The...

Read More

Turn Off the TV

“Our obsession with being informed makes it hard to think long-term. We spend hours consuming news because we want to be informed. The problem is,...

Read More

Pure Portfolios’ April 2025 Market Commentary

Markets declined by ~13% in April before recovering to end the month nearly flat. This marked one of the largest intra-month reversals in market history....

Read More

Does it Still Make Sense to Own Bonds?

“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but by aging boomers.” – Bill Gross, retired...

Read More

Closest Thing to a Fat Pitch in Investing

“Interest rates go up and down, stock markets boom and bust, but human psychology never changes. I believe that studying how people think about and...

Read More

Tariff Talk: Client Q&A on Market Impact and Economic Risks

“The higher returns to quantitative investing accrue from the abnormally bad behavior of humans at times of crisis.” – Dan Rasmussen, author of The Humble...

Read More

Is Your Retirement Plan Ready for Market Volatility?

Market uncertainty is the rule—not the exception. Interest rate hikes, inflation pressures, and political noise aren’t going away anytime soon. If you’re nearing or in...

Read More

Pure Portfolios’ March 2025 Market Commentary

In Pure Portfolios’ March 2025 Commentary, Chief Investment Officer, Nik Schuurmans unpacks the growing disconnect between investor sentiment and market fundamentals. Watch the video below…...

Read More

5 Tasks to Add to Your Spring Cleaning List

Springtime signals renewal—a perfect opportunity not only to clean your home but to tidy up your finances as well. Add these tasks to your list...

Read More

Why This Correction Hits Harder

“In investing and life, you will make better decisions if you assume you are wrong and try your best to prove it by finding the...

Read More

Global Markets are Telling a Different Tariff Story

“Tariffs are a tax on business that get eaten by the consumer.” – Cullen Roche, Pragmatic Capitalism We won’t pretend the headline risk of tariff...

Read More

Fully Invested, Light on Cash

“My most important discovery—a finding that changed the course of my career—is that the future is far less predictable than most investors think. The best...

Read More

Pure Portfolios’ February 2025 Market Commentary

In Pure Portfolios’ February 2025 Commentary, Chief Investment Officer, Nik Schuurmans covers headline risk, AI trade fatigue, seasonality, corporate credit spreads, and volatility. Watch the...

Read More

Avoid RMD Pitfalls: Smart Strategies for Retirees

If you’re nearing retirement or already enjoying it, you’ve likely heard about Required Minimum Distributions (RMDs). But for many, the mention of RMDs brings a...

Read More

Myth Busting: What the Government Cannot Do

“Stories are always more powerful than statistics.” – Morgan Housel, Same as Ever There’s lots of wild theories rolling around about what the federal government...

Read More

The Best Age to Start Social Security

When it comes to retirement, few decisions feel as weighty as when to claim Social Security. Do you take it early and lock in a...

Read More

Err on the Side

“Most people make their investment decisions on the basis of an unreliable hodgepodge of half-baked logic, biases, hunches, emotion, and vague fantasies or fears about...

Read More

Pure Portfolios’ January 2025 Market Commentary

In Pure Portfolios’ January 2025 Commentary, Chief Investment Officer, Nik Schuurmans covers the illusion of diversification, the Deep Seek disruption, Nvidia’s massive selloff, and the...

Read More

Estate Planning 101: Should You Choose a Will or a Living Trust?

Estate planning might not be the most exciting topic, but it’s one of the most thoughtful ways to protect your family’s future. Whether you want...

Read More

No One Learns Anything in a Bull Market

“Mistakes present a choice: whether to update your ideas, or ignore the failures they’ve produced and keep believing what you’ve always believed.” – Shane Parrish,...

Read More

Don’t Believe Everything You Hear on Tariffs

“Everybody talks about tariffs as the first thing. Tariffs are the last thing. Tariffs are part of the negotiation. The real trick is going to...

Read More

Will Outsized U.S. Stock Returns Continue?

“When something is on the pedestal of popularity, the risk of a decline is high. When people assume — and price in — an expectation...

Read More

Pure Portfolios’ December 2024 Market Commentary

In Pure Portfolios’ December 2024 Commentary, Chief Investment Officer, Nik Schuurmans reflects on a year of market resilience and the set-up heading into 2025. Nik...

Read More

Pure Portfolios’ 2024 Client Letter

As we approach the year’s end, we at Pure Portfolios want to take a moment to thank you for your trust and partnership in 2024....

Read More

Tis the Season for Wall Street Forecasting VIII

“A decade ago, I made a goal to read more history and fewer forecasts. It was one of the most enlightening changes of my life.”...

Read More

Pure Portfolios’ 2024 Reading List

“Books and doors are the same thing. You open them, and you go through into another world.” – Jeanette Winterson, English author I’ve asked the...

Read More

Pure Portfolios’ November 2024 Market Commentary

In Pure Portfolios’ November 2024 Commentary, Chief Investment Officer, Nik Schuurmans, covers how the market tends to overshoot post-election, how stocks perform when one party...

Read More

Reckless Government Spending: How it Could Impact Your Investments

“We are going to be broke really quickly unless we get serious about dealing with our spending issues.” – Paul Tudor Jones, hedge fund manager...

Read More

Could Future S&P 500 Returns Be Lower?

“History doesn’t repeat, but it often rhymes.” – Mark Twain Anyway you slice it, the S&P 500 is historically expensive. The conundrum for those waiting...

Read More

Pure Portfolios’ October 2024 Market Commentary

In Pure Portfolios’ October 2024 Commentary, Chief Investment Officer, Nik Schuurmans, covers asset class returns & falling inflation, how often the U.S. economy is in...

Read More

Consumer Sentiment and S&P Returns

“There is a very thin line between confidence and arrogance.” – Adam Peaty, Olympic swimmer What comes first, confidence or success? It’s a question I’ve...

Read More

The Danger of Recency Bias in Investment Decisions

“Why would I own anything other than the S&P 500?” “I’m thinking of putting my entire retirement nest egg in the S&P 500 and calling...

Read More

Fed Cuts and Mortgage Rates Higher?

“Just wait until the Fed cuts, the housing market is going to get white hot.” – random real estate agent Do you know someone that...

Read More

Let’s Freak Out About the Election (Seriously)

We have penned blog after blog how elections are a non-event in the grand scheme of your investment portfolio. We recorded a video outlining every...

Read More

Pure Portfolios’ September 2024 Market Commentary

In Pure Portfolios’ September Commentary, Chief Investment Officer, Nik Schuurmans, covers the Fed pivot & future S&P 500 returns, softening labor market, and the borrowing...

Read More

What’s NOT Going to Change in 10 years?

“When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”...

Read More

This Market Signal is Flashing Red

“If the average investor allocation to equities is abnormally high, then prices are probably abnormally high–the market’s probably expensive.” – Jesse Livermore, famous investor Let’s...

Read More

Pure Portfolios’ August 2024 Market Commentary

In Pure Portfolios’ August Commentary, Chief Investment Officer, Nik Schuurmans, covers rate cuts & future returns, the quiet comeback of bonds, and why the “misery...

Read More

Rate Cuts and Stock Returns

“Whoever controls the volume of money in any country is absolute master of all industry and commerce.” – James A. Garfield, 20th President of the...

Read More

Characteristics of a Bull Market

“Bull markets ignore bad news, and any good news is reason for a further rally.” – Colm O’Shea, professor at New York University The latest...

Read More

Market Correction Reflection

“The purpose of volatility is to make people make stupid decisions.” – Jared Dillion, The Daily Dirt Nap Yen carry trade Weak jobs report Fed...

Read More

Pure Portfolios’ July 2024 Market Commentary

Last month, we highlighted the historical gap between U.S. large cap stocks and smaller companies. July saw a massive reversal with small cap stocks staging...

Read More

What Should Retirees Pay Attention To?

“The information you consume each day is the soil from which your future thoughts are grown.” – James Clear, Atomic Habits “What have you been...

Read More

Picking Individual Stocks is Hard

“Owning individual stocks invites infinitely more behavioral hurdles than a simpler strategy. It’s easier to ignore index funds and ETFs. You can’t ignore individual stocks.”...

Read More

Unprecedented Uncertainty

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” – Charlie Munger, Co-founder of Berkshire Hathaway Unprecedented volatility Unprecedented...

Read More

Pure Portfolios’ June 2024 Market Commentary

In Pure Portfolios’ June 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers U.S. large cap extremes relative to small cap & value stocks, the...

Read More

Tale of Two Markets

“What you see is not what others see. We inhabit parallel worlds of perception, bounded by our interest and experience. What is obvious to some...

Read More

Probable Probabilities

“The biggest risk is always what no one sees coming, because if no one sees it coming, no one’s prepared for it; and if no...

Read More

The Longest Drawdown in Recent History

“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but aging boomers.” – Bill Gross, PIMCO founder...

Read More

Pure Portfolios’ May 2024 Market Commentary

In Pure Portfolios’ May 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers retailers reducing prices, gold’s sneaky good run, and the AI boom. Is...

Read More

To Convert or Not Convert? Roth is the Question

Just as diversification is important in investing, it’s equally important in retirement planning. By diversifying your assets across different types of accounts—taxable, tax-deferred, and tax-free—you...

Read More

Principled Investing

“The dead outnumber the living fourteen to one, and we ignore the accumulated experience of such a huge majority of mankind at our peril.” —Niall Ferguson,...

Read More

The Benchmark Fallacy

“The highest form of wealth is the ability to wake up every morning and say: ‘I can do whatever I want today.” — Morgan Housel,...

Read More

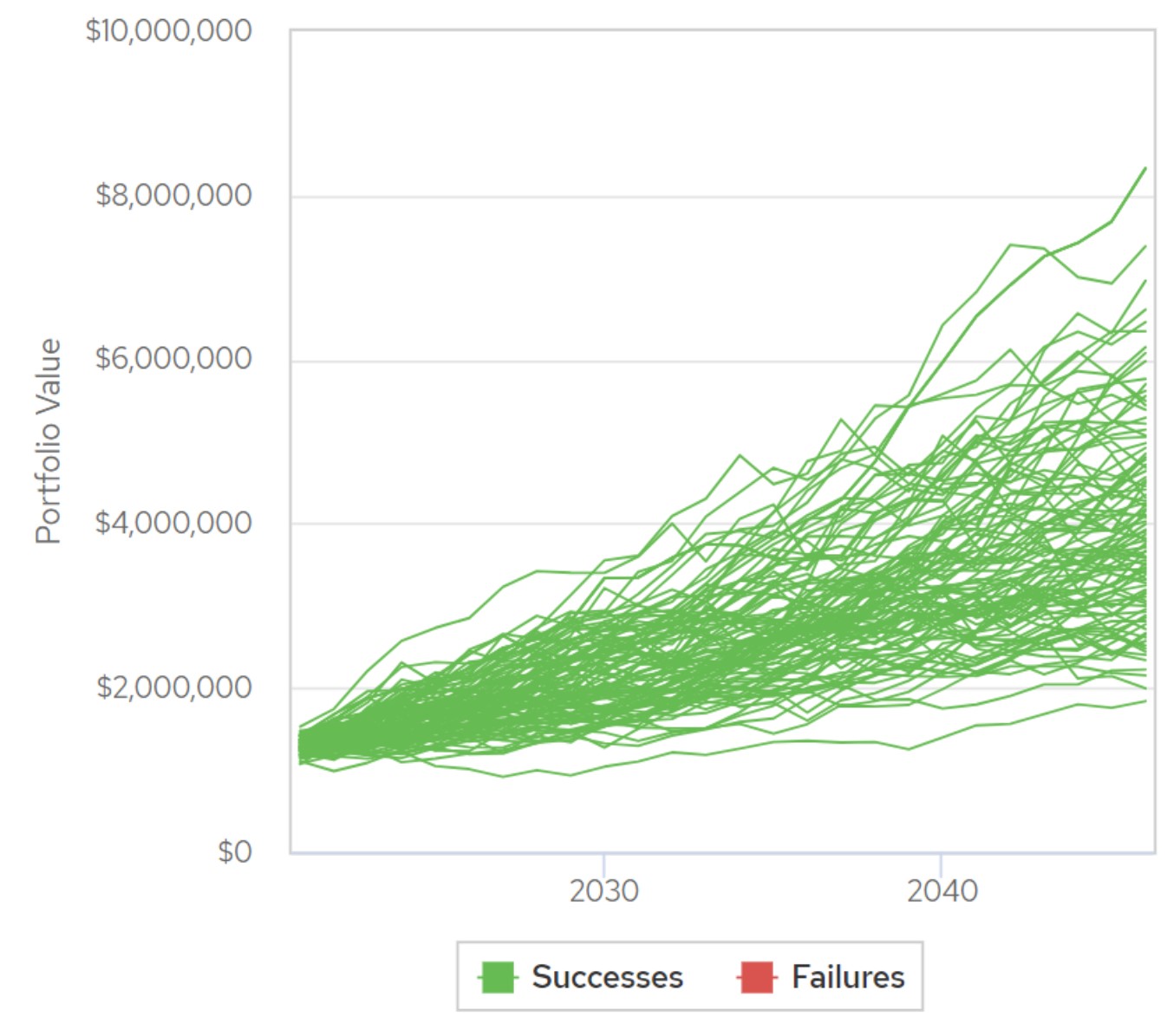

Understanding Safe Withdrawal Rates

One of the key considerations in retirement planning is determining a safe withdrawal rate – the pace at which you can draw down your savings...

Read More

Pure Portfolios’ April 2024 Market Commentary

In Pure Portfolios’ April 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks intra-year S&P 500 drawdowns, stubborn inflation, the crazy journey of the Magnificent...

Read More

Rush to Riches

“Slow success builds character. Fast success builds ego.” Ratan Tata, former chair of Tata Group A young golfer approaches her swing coach and asks, “How...

Read More

Markets After Major Geopolitical Events

“The world changes. This is the biggest problem in markets.” – Bill Miller, former chairmen of Legg Mason Capital Management T. Rowe Price, founder of...

Read More

Hot Themes and Future Returns

“I didn’t learn anything. I already knew I wasn’t supposed to do that.” – Stanley Drunkenmiller, after losing $3 billion dollars on tech stocks. The...

Read More

Can the Market Predict the Next President?

“If you mix your politics with your investment decisions, you’re making a big mistake.” – Warren Buffett, Berkshire Hathaway It is not a secret 2024...

Read More

Pure Portfolios’ March 2024 Market Commentary

In Pure Portfolios’ March 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks high yield credit spreads, elevated U.S. stock valuations & future returns, and...

Read More

Estimating Future Equity Returns

“We deceive ourselves when we believe that past stock market return patterns provide the bounds by which we can predict the future.” – John Bogle,...

Read More

The Resilience of the U.S. Economy

Let’s go back to summer of 2022. It wasn’t a matter of if a recession was coming, rather a matter of when. From our July...

Read More

Why Not Go All-In on the S&P 500?

“I might just put my money in the S&P 500 and call it good. “ – anonymous prospective client The drumbeat is growing louder as...

Read More

Pure Portfolios’ February 2024 Market Commentary

In Pure Portfolios’ February 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks the struggles of rate sensitive assets, why all-time highs are nothing to...

Read More

The Most Valuable Financial Advisor Task

“Investors are always searching for good ideas, when what they need are good habits.” – Jason Zweig, Wall Street Journal & author If you asked...

Read More

Is There Such a Thing as “Safe” Stocks?

“People want to believe that this time is different, that there’s something new under the sun, and through their own ingenuity they can wish risk...

Read More

How High Interest Rates Impact Financial Decisions

“Invest in preparedness, not prediction.” – Morgan Housel, Collaborative Fund Financial planning is important because it helps clients understand where they stand today and what...

Read More

Pure Portfolios’ January 2024 Market Commentary

In Pure Portfolios’ January 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers January performance and what it could mean for the rest of the...

Read More

Bitcoin: Understanding the Digital Asset

“You can’t stop things like Bitcoin. It will be everywhere, and the world will have to re-adjust. World governments will have to re-adjust.” —John McAfee,...

Read More

Cash is Not a Long-term Investment

“In investing, what is comfortable is rarely profitable.” – Robert Arnott, founder of Research Affiliates Cash is comfortable. It’s also finally producing some interest income...

Read More

How to Create a Realistic Budget

“The budget is not just a collection of numbers, but an expression of our values and aspirations.” – Jacob Lew It’s not what the market...

Read More

The Why in Diversify

“Diversification means always have to say you’re sorry.” – Brian Portnoy, founder of Shaping Wealth “Why do we own these bond ETFs? They haven’t done...

Read More

December 2023 Market Commentary

In Pure Portfolios’ December 2023 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers the market climbing the wall of worry, S&P 500 returns in an...

Read More

Pure Portfolios’ 2023 Client Letter

There’s an old parenting quip, “the days are long, but the years are short.” The saying can be attributed to parents of young children who...

Read More

Pure Portfolios’ 2023 Reading List

“In my whole life, I have known no wise people who didn’t read all the time — none, zero. You’d be amazed at how much...

Read More

Tis the Season for Wall Street Forecasting Pt. VII

“The need for certainty is the greatest disease the mind faces.” – Morgan Housel, from his new book, “Same as Ever.” The holiday season is...

Read More

This is Why We Invest: Long-Term View on Markets

“Pessimists sound smart. Optimists make money.” It’s easy to get sucked into what could go wrong. In the digital age, if something is awry in...

Read More

November 2023 Market Commentary

In Pure Portfolios’ November 2023 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers the ‘Three Headed Monster’; the 10-year Treasury yield, oil prices, and the...

Read More

Latte with Nik: If I Didn’t See It, I Wouldn’t Believe It

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” – Seth Klarman, hedge...

Read More

Wall Street is Bearish: That’s a Good Thing

“The best way to tell when a trend is going to reverse is when it fills up with a-holes.” – Jared Dillion, author It’s a...

Read More

October 2023 Market Commentary

“The era of optimism dies in a crisis, but in the dying it gives birth to an era of pessimism.” – Arthur Cecil Piguo, British...

Read More

The Fed Could be in the Bottom of the 9th

“We believe we are in a new era for fixed income in which bonds offer significantly more value.” – Vanguard on the attractiveness of fixed...

Read More

The Recession that Never Came

“It’s the economy, stupid.” – James Carville, political analyst Go back to any point in 2022. You’re likely to find thousands of headlines that look...

Read More

The Investor Mindset: Fixed vs. Growth

“Self-control is a key to investing success, but so is fending off self-delusion.” – Jason Zweig, Wall Street Journal & financial author I tend to...

Read More

When Safe Assets Become Risky

“There is no such thing as a riskless hedge against inflation.” – Edgar Fiedler, economist and former U.S. Assistant Secretary of the Treasury for Economic...

Read More

September 2023 Market Commentary

“If I depended on economic forecasts, I don’t think we’d make any money.” – Warren Buffett, Berkshire Hathaway In Pure Portfolios’ September 2023 Market Commentary,...

Read More

Starting Yield and Future Bond Returns

“Remember how excited people were about bonds when rates were under 1%? You see how bearish people are about bonds today, with yields at 4.5?”...

Read More

Hot 2024 Presidential Election Talk

“If you mix your politics with your investment decisions, you’re making a big mistake.” – Warren Buffett, Berkshire Hathaway Benjamin Franklin famously stated, “Nothing is...

Read More

Past Performance and Investment Decisions

“My investment plan was built with the assumption that I would experience a number of both bull and bear markets over the years.” – Ben...

Read More

August 2023 Market Commentary

“You should follow price. Quit trying to be an expert, follow prices and follow trend.” – Jerry Parker, Chesapeake Capital In Pure Portfolios’ August 2023...

Read More

The Big Short’s, Big Short

“Everything I do in investing is just very different.” – Michael Burry, famous investor featured in “The Big Short” Michael Burry predicted the 2008 housing...

Read More

The Plight of the Dividend Investor

“If company management can’t think of anything else to do with their money, they should pay dividends. If they have good places to invest, that’s...

Read More

Is the Market Detached from Reality?

“Wealth isn’t primarily determined by investment performance, but by investor behavior.” – Nick Murray, finance author & speaker The U.S. equity market has come roaring...

Read More

The Loneliest Trade

“If it’s obvious, it’s obviously wrong.” – Stanley Druckenmiller, former founder of Duquesne Capital Most investors know about the sterling performance of big technology stocks...

Read More

July 2023 Market Commentary

“One lesson I learned is to make fewer decisions. Sometimes the best thing to do is nothing.” – Lou Simpson, former Berkshire Hathaway employee In...

Read More

The Retirement Propaganda War

“I’ve found that investors who rely on crystal balls frequently wind up with crushed glass.” – Martin Zweig, famous investor I haven’t seen anything like...

Read More

Juicy Money Market Yields Won’t Last

“The Fed’s ability to raise and lower short-term interest rates is its primary control over the economy.” – Alex Berenson, writer & author We don’t...

Read More

Hey Retirees, the 4% Rule is Back

“At the end of the day, it’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein, former CEO of Goldman Sachs...

Read More

June 2023 Market Commentary

“The idea that a bell rings to signal when to get in or out of the market is simply not credible. After fifty years in...

Read More

When a Bear Becomes a Bull

“When investors get negative on the market and put 50% in cash, many times it’s just about when the market is about to rally.” –...

Read More

Can AI Pick Investments?

“Some people call this artificial intelligence, but the reality is this technology will enhance us. So instead of artificial intelligence, I think we’ll augment our...

Read More

Mega Cap Fueled Rally

“The market is being driven by the performance of only 7 stocks!” – Everyone Yes, it’s true. The S&P 500’s 2023 performance is being propelled...

Read More

May 2023 Market Commentary

“Timing crashes is impossible. If you require a forecast for your investment thesis to do well, then you’re doing it wrong.” – Mark Spitznagel, hedge...

Read More

How Much Cash is Too Much?

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis, famous investor Generating...

Read More

Falling Inflation and Stock Returns

“The complaints about how sticky inflation has been nearly matches the claims that it was transitory back in 2021.” – Bespoke Investment Group On November...

Read More

The U.S. Debt Ceiling

“I think it’s ridiculous – it’s always resolved, not that it’s a 100% chance, but I think it gets resolved.” – Bill Gross, Pimco co-founder...

Read More

Market Expectations are Everything

“The past wasn’t as good as you remember. The present isn’t as bad as you think. The future will be better than you anticipate.” Morgan...

Read More

April 2023 Market Commentary

“If you want to call it a bear market, it looks as savage as a koala. If you want to call it a bull market,...

Read More

The Demise of King Dollar

“People talk about this concept like foreign countries can just choose not to do business with the U.S. Dollar. Sure, they can. In doing so,...

Read More

Back to Back Calendar Year Losses for Stocks

“In my experience, most people who are lucky enough to sell something before it goes down get so busy patting themselves on the back, they...

Read More

The Market is Quietly Stacking Up Wins

“It’s just that most people see what they want to see. We pride ourselves on living in reality.” – J.C. Parets, All-Star Charts, on the...

Read More

March 2023 Market Commentary

“History provides crucial insight regarding market crisis; they are inevitable, painful, and ultimately surmountable.” – Shelby M.C. Davis, philanthropist and investor Pure Portfolios’ Chief...

Read More

Bond Returns Following Difficult Years

“It’s not that I’m so smart; it’s just that I stay with problems longer.” – Albert Einstein Bonds could use a public relations makeover. The...

Read More

Not a Typical Bank Failure

“This isn’t just one stupid bank making bad decisions. This is a real economic problem where the clients at Silicon Valley Bank were burning money...

Read More

The Biggest Heist No One is Talking About

“Banks do not create money for the public good. They are businesses owned by shareholders. Their purpose is to make a profit.” – John Rogers,...

Read More

February 2023 Market Commentary

“The main purpose of the stock market is to make fools of as many people as possible.” – Bernard Baruch, American financier Pure Portfolios’ Chief...

Read More

Retirees: More is the Enemy of Enough

“Don’t risk what you have and need for what you don’t have and don’t need.” – Warren Buffett There’s a group of Twitter overachievers that...

Read More

Assets That Could Hold Up During a Recession

“Fear, greed and hope have destroyed more portfolio value than any recession or depression we have ever been through.” – James O’Shaughnessy, Founder of O’Shaughnessy...

Read More

Six Investing Lessons from 2022

“I have civilized my own subjects; I have conquered other nations; yet I have not been able to civilize or conquer myself.” – Peter the...

Read More

January 2023 Market Commentary

“In investing, what is comfortable is rarely profitable.” – Robert Arnott, Research Affiliates Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, unpacks the first month of...

Read More

U.S. Debt Ceiling Fiasco: Big Risk or Big Nothing?

“Playing political football with a vote to raise the nation’s debt ceiling has become as predictable as a Twitter rant from Charlie Sheen.” – Peter...

Read More

The Perception of Risk

Quick question, which below stock market graph would you deem more risky? Graph A or B? Graph A Source: Koyfin, Pure Portfolios The above graph...

Read More

Investment Themes by Decade

“Owning US tech was the trade of the last decade. Look forwards not backwards. That trade is over. What will be the one to take...

Read More

December 2022 Market Commentary

“With every investment we become richer or wiser, never both.” – Bill Duhamel, investor Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, unpacks the rollercoaster...

Read More

Santa Claus Rally, Fact or Fiction?

“The real rally could come not from Santa Claus, but from Federal Reserve Chairman Jerome Powell, who will decide how much longer to hike interest...

Read More

Pure Portfolios’ 2022 Reading List

“Reading a book isn’t a race – the better the book, the slower it should be absorbed.” – Naval Ravikant, author & investor I’ve asked...

Read More

Tis the Season for Wall Street Forecasting Pt. VI

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – John Kenneth Balbraith, economist Hot chocolate....

Read More

November 2022 Market Commentary

“As crisis is comprised of danger and opportunity, those who sense change in the early stages will tend to have the most bountiful harvest.” –...

Read More

Top 5 Pure Portfolios’ Blogs: Turkey Edition

“Thanksgiving is a joyous invitation to shower the world with love and gratitude.” – Amy Leigh Mercree We take a break from our regular blog...

Read More

Avoiding the Extremes

“You should obsess over risks that do permanent damage & care little about risks that do temporary harm, but the opposite is more common.” –...

Read More

Mid-Terms and Markets

“Historically, investors overestimate the impact of political parties, Presidents, and legislation. Even if one was to correctly forecast a political outcome, markets seldom react in...

Read More

When the Fed Pivots

“History never repeats itself, but it does often rhyme.” – Mark Twain There have been 85 cycles where the Fed has increased interest rates since...

Read More

October 2022 Market Commentary

“If everyone is thinking alike, somebody isn’t thinking.” – General Patton Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks sticky inflation, the U.S. consumer,...

Read More

Silver Linings in a Dismal Year

“It’s not just good news that causes bear markets to end, but better-than-expected news that is simply less bad.” – Ben Carlson, Wealth of Common...

Read More

Surprised by Surprises

“The correct lesson to learn from surprises is that the world is surprising.” – Morgan Housel, The Collaborative Fund Unprecedented. Extraordinary. Unexpected. Once in a...

Read More

Year of the 180

“Most investors tend to project near-term trends – both favorable and adverse indefinitely into the future.” – Seth Klarman, famous investor Let’s go back to...

Read More

September 2022 Market Commentary

“My first boss told us, what’s obvious is obviously wrong. It’s already reflected in security prices. The world changes. And you’re only going to pick...

Read More

The Market Could Be Wrong About Inflation

“I don’t mind going back to daylight savings time. With inflation, the hour will be the only thing I’ve saved all year.” – Victor Borge,...

Read More

Fighting the Urge to Throw in the Towel

“If a topic makes someone feel emotional, they will rarely be interested in the data. This is why emotions can be such a threat to...

Read More

Where to Find Investment Income

“Big banks, highly leveraged casinos, do whatever they can to keep the cost of their gambling as cheap as possible.” – Max Keiser, American Journalist...

Read More

August 2022 Video Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks the Fed’s Jackson Hole meeting, yield curve, strength of the U.S. dollar, and more. Let us know...

Read More

Intra-Year Market Declines

“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends in a panic.” – Jim...

Read More

Calling Market Inflection Points

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis, investor, businessman, former...

Read More

The Biggest Risk to Retirees Revisited

“The most important part of a plan is planning on your plan not going according to plan.” – Morgan Housel, author & investor The last...

Read More

July 2022 Market Commentary

“It would be silly to expect every bear market to turn into the Great Depression. It would be equally wrong to expect that a fall...

Read More

Signs of a Market Bottom

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain I post my blog every week on LinkedIn. Last week, I wrote about what...

Read More

Which Asset Class Has it Right?

“Majority opinion can give any market movement considerable momentum that keeps it going in the same direction. Majority opinion is inevitably and consistently wrong at...

Read More

Recession Obsession

“When y’all think they going to announce that we going into a recession?” – Cardi B, famous hip hop artist Forecasting the next recession has...

Read More

June 2022 Market Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks bear markets, bond yields, prospects of a recession, and much more. The video is heavy on...

Read More

Bear Market Blues, How Much Worse Can it Get?

“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends in panic.” – Jim Rogers,...

Read More

Just How Bad is Inflation?

The inflation report on 6/10/22 caused shockwaves across financial markets. The Consumer Price Index (CPI) print surprised on the upside, which wasn’t a good thing....

Read More

Sniffing Around for Investment Opportunities

“Cash shouldn’t be looked at as a burden or drag on your portfolio. It should be viewed as a weapon waiting for an opportunity to...

Read More

May 2022 Market Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks factor performance, global markets, the Fed’s balancing act, and cracks in U.S. housing. The video is heavy...

Read More

Investment Royalty to Punching Bag

“Cathie Wood’s stubborn reluctance to accept reality is starting to look less and less like an investment advisor and more like me betting the midnight...

Read More

Fighting the Market-Timing Urge

“If a topic makes someone feel emotional, they will rarely be interested in the data. This is why emotions can be such a threat to...

Read More

Market Sell-Off: The Good & Bad

“Everything feels unprecedented when you haven’t engaged with history.” – Kelly Hayes, author The daily flow of negative headlines, market losses, and dire predictions can...

Read More

Sell in May and Enjoy the Day?

“In real-time, every crisis feels like the worst thing ever. In hindsight, every crisis is an obvious buying opportunity.” – Morgan Housel, author This isn’t...

Read More

April 2022 Market Commentary

Trying to make sense of the economy and markets? We’ve got your back. Pure Portfolios’ Chief Investment Officer talks market action, the Fed’s current...

Read More

What Does Peak Inflation Look Like?

“Every administration thought they had power to end inflation but they really didn’t. I think now you can see that same sense of overconfidence in...

Read More

Does it Still Make Sense to Own Bonds?

White-hot inflation. Rising interest rates. Tanking bond prices. The popular consensus is that investors should abandon their bond allocation. It’s a tidy narrative but deserves...

Read More

March 2022 Market Commentary

“The main purpose of the stock market is to make fools of as many people as possible.” – Bernard Baruch, famous investor In the...

Read More

What’s the Bullish Case for Stocks?

“Tell someone that everything will be ok and they’ll shrug you off. Tell someone they’re in danger and they’ll hang on your every word.” Morgan...

Read More

Mitigating Damage without Playing the Market Oracle

“Imagine thinking you could predict when you would sprain your ankle or get in a car crash. Instead, develop the ability to absorb damage. Train...

Read More

What Are the Odds of a U.S. Recession?

“Being scared of everything is a symptom of being addicted to comfort.” – Orange Book, @orangebook on Twitter Post World War II, the U.S. has...

Read More

February 2022 Market Commentary

What the heck is going on in financial markets? In the below month-end video recap, Pure Portfolios President & CIO Nik Schuurmans, CFA offers his...

Read More

Checking Up on Pandemic Darlings

“What a year this week has been.” – unknown A handful of stocks couldn’t miss. The pandemic changed the way we did everything overnight. Obscure...

Read More

How to Solve the Inflation Problem

“Anyway you calculate it, inflation is WAY above the Fed’s target because of high demand.” Cullen Roche, Discipline Funds The Fed will attempt to kill...

Read More

Waiting for the “All-Clear” Investment Signal

“If you want to make the wrong decision, ask everyone.” – Naval Ravikant, author and investor I want to wait and see what happens with...

Read More

How High Can Bond Yields Go?

“It’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein, former Goldman Sachs CEO The Fed has charted the path forward...

Read More

What Goes Up, Must Come Down

“All past market declines look like opportunities, all future market declines look like risks.” – Morgan Housel, author and investor Watching the stock market tank...

Read More

Throw Away the Old Playbook

“Much of the confusion about the current state of the economy has its origin in people trying to apply classic business-cycle analysis to COVID-19 macro...

Read More

Managing Market Volatility

“Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when they’re stable.” – Peter Bernstein,...

Read More

Pure Portfolios’ 2022 Client Letter

2022 was the year of the opposite. Every market trend and economic reality we’ve known to be true the last ~12 years swung the other...

Read More

How Does this Bull Market Stack Up?

“Everyone is a genius in a bull market.” Mark Cuban, entrepreneur and owner of the Dallas Mavericks. There’s no shortage of investors & pundits telling...

Read More

Pure Portfolios’ 2021 Client Letter

2021 marks the five-year anniversary of Pure Portfolios (see The Story of Pure Portfolios). We are grateful for the client relationships we’ve built along the...

Read More

Pure Portfolios’ Best of 2021

“A fit body, a calm mind, a house full of love. These things cannot be bought — they must be earned.” – Naval Ravikant, entrepreneur...

Read More

Tis the Season for Wall Street Forecasting Pt. V

“I am skeptical about stock market forecasting by anybody, and particularly by bankers.” Benjamin Graham, famous investor Historical evidence shows Wall Street makes predictions that...

Read More

Sniffing All-Time Highs and Nobody is Happy

“We locked down the economy for 18 months, spent ~$14 trillion, and now my margarita costs 30% more.” – Cullen Roche, author & investor. We...

Read More

What is the Right Stock Allocation for Retirees?

“The trouble with retirement is that you never get a day off.” – Abe Lemons, college basketball coach It’s a delicate balance every retiree faces....

Read More

How to Reduce Capital Gains in your Portfolio

“A fine is a tax for doing something wrong. A tax is a fine for doing something right.” Anonymous You sold a large chunk of...

Read More

Not All Indexing is Good

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.”...

Read More

Worried About Inflation? You Might Own These Assets

“Inflation sparks heated debates because everyone spends their money differently so there’s no single inflation rate — your inflation may be very different than someone...

Read More

When Was the Last Time you Changed your Mind?

“If I were tasked with building the ultimate human investor, being able to change one’s mind would be the number one skill on the list.”...

Read More

How Does a Fed Taper Affect Market Volatility?

“Our discussions of the economy may sometimes ring in the ears of the public with more certainty than is appropriate.” Jerome Powell, Federal Reserve Chairman...

Read More

Is There Ever a Good Reason to Panic Sell?

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” Peter Lynch, famous investor. The below exchange...

Read More

Is a Roth Conversion Right for You?

To convert or not to convert? Too often investors want to convert to a Roth IRA without fully understanding the risks, benefits, and how a...

Read More

Is Market Volatility Still Elevated?

“Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when they’re stable.” – Peter Bernstein,...

Read More

Can Stocks Get Cheaper and Go Higher?

“History shows us, over and over, that bull markets can go well beyond rational valuation levels as long as the outlook for future earnings is...

Read More

Why are ETFs Tax-Efficient?

“Those of you who make investments outside of any retirement accounts are absolutely crazy if you are using actively managed funds rather than ETFs.” Suze...

Read More

An Investor’s Two Most Powerful Weapons

“It might make sense to hedge some of your equity risk.” – Toby Weber, Pure Portfolios “I’m 72 years old. Why would I spend my...

Read More

Why Trend Following Could Make Sense for Retirees

“To be uncertain is to be uncomfortable, but to be certain is to be ridiculous.” – Michael W. Covel, American author. Most investors have heard...

Read More

The Untold Story of Pure Portfolios

August 2021 marks the five-year anniversary of Pure Portfolios. This is the untold story of how we launched. The Build-Up I was searching for a...

Read More

Taking Cues from the Market

“In the end, how your investment behaves is much less important than how you behave.” – Benjamin Graham, famous investor Much had changed, but nothing...

Read More

Intoxicated with Pessimism

“Optimism sounds like a sales pitch. Pessimism sounds like someone is trying to help you.” – Morgan Housel, The Collaborative Fund Bill has financial freedom....

Read More

Avoiding Stupidity is Underrated

“All I want to know is where I’m going to die, so I’ll never go there.” – Charlie Munger, Berkshire Hathaway Let’s say you’re having...

Read More

It’s Been Too Easy

“Expectation is the root of all heartache.” – William Shakespeare Under promise, over deliver. The universal mental shortcut for managing expectations. Set the bar low,...

Read More

Retirement Simplicity is Beautiful

“Life is really simple, but we insist on making it complicated.” – Confucius, Chinese philosopher My morning inbox routine, delete, delete, delete… “Boom in Securities-Based...

Read More

Not So Obvious

“Hindsight is 20/20.” – Richard Armour, American comedian What was unclear 12-18 months ago, looks clear as day now. I knew the market would come...

Read More

Predicting Irrational Beasts

“We are emotional, irrational beasts who are emotional and irrational in predictable, pattern-filled ways.” – Chris Voss, author of Never Split the Difference. Stanley sold...

Read More

Internal vs. External Focus

“Do not let what’s out of your control interfere with all the things you can control.” – John Wooden, legendary UCLA basketball coach. I have...

Read More

The Difference Between Amateur and Professional Investors

“Amateurs believe that the world should work the way they want it to. Professionals realize that they have to work with the world as they...

Read More

What the Treasury Market is Saying About Inflation

“Inflation is when you pay $15 for a $10 haircut you used to get for $5 when you had hair.” – Sam Ewing, retired professional...

Read More

Shrinking Life Cycle of an S&P 500 Company

“I’d rather be partly great than entirely useless.” – Neal Shusterman, American author & writer. Let’s face it, it’s fun to buy individual stocks. Maybe...

Read More

The Best Predictor of Stock Returns is Amazingly Simple

“The price of equity is determined in the same way that the price of everything is determined – via forces of supply and demand.” Jesse...

Read More

The Biggest Risk to New Retirees

“Consider two degenerate gamblers flipping a quarter for $100 per flip. One of the gamblers has heads and the other has tails for the duration...

Read More

What’s in a Bear Market?

“I’m an optimist, both as a person and an investor. It’s a big mistake to be pessimistic as long as we have a viable civilization...

Read More

Higher Capital Gains Tax and Stock Returns

“You watch…taxes are going to go up and the market will tank.” – I’ve been told this 5x in the past week. Well, that seems...

Read More

No Such Thing as Passive Investing

“This is the single worst time to be a passive investor since they started passive investments. The S&P 500 index is highly likely to not...

Read More

Spectacular Implosion

“How did you go bankrupt?” “Two ways. Gradually, then suddenly.” – Ernest Hemingway, The Sun Also Rises. It takes talent to lose $8 billion dollars...

Read More

The Identity Leak

“Keep your identity small.” – Paul Graham, famous investor. I was an average high school basketball player. Good enough to get on the court, but...

Read More

Not Buying What the Fed is Selling

The Fed was on autopilot. Its forward guidance made clear that market participants could set their watches to four interest rate hikes in 2018. That’s...

Read More

The New Age Investor

“Behind the recent surge in retail investing is a younger, often new-to-investing, and aggressive cohort not afraid to employ leverage.” Deutsche Bank strategists Jim Reid...

Read More

Beating the Bubble Horse

“I’m just waiting for the bubble to pop.” – Anonymous potential client Have you ever met the type that thinks everything is in a bubble?...

Read More

Perspective on Rising Bond Yields

“Bonds are dead.” – Warren Buffett via CNBC The recent uptick in yields has the reignited the “bonds will get crushed” angry mob. We can...

Read More

Bitcoin, What Of It?

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase...

Read More

Investing at All-Time Highs

In the early years of the smartphone, it was quite common to carry a personal cell and a work cell. Eventually, we wised up at...

Read More

Is the 4% Rule Dead?

Mental shortcuts or heuristics are used to make quick decisions, either because of time constraints or to simplify a complex problem. The further away a...

Read More

Is Inflation Coming?

The health and wellness gurus will tell you that they meditate for two hours, exercise, and eat egg whites all before 6am. I check my...

Read More

Monte Carlo Analysis: Worthless or Worthwhile?

“Oh, Monte Carlo, I’ve done that. It’s worthless!” “This simulation is the greatest thing ever!” “I don’t know what I’m going to do. I’m waiting...

Read More

Is Your Portfolio Drunk or Sober?

“Take calculated risks. That is quite different from being rash.” – George S. Patton Let’s say I’m invited over to your house for dinner. We...

Read More

The Blue Wave and Stock Returns

““We are beginning to see trends that people tend to fear what they are exposed to in the media. Many of the top 10 fears...

Read More

Getting a Fat Pitch and Not Swinging

“Amateurs think the world should work the way they want it to. Professionals realize that they have to work with the world as they find...

Read More

What is Your “Enough?”

“Mo money, mo problems.” – Notorious B.I.G Unless your name is Jeff Bezos, most of us will never be the richest person on the planet....

Read More

Investing in a 0% World

“Zero rates aren’t a new normal; they’re just normal in Japan.” – Verdad Capital That didn’t last long. After four years of “normalizing” rates from...

Read More

Good from Far, but Far from Good

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very...

Read More

Scratching Your Degenerate Itch

“Bad bets sometimes pay off.” – Marty Rubin, Canadian Author There’s been a stir in financial media about Robinhood traders bidding up bankrupt companies to...

Read More

Investing Cash in a Runaway Market

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter...

Read More

The Brilliance of “I Don’t Know”

“We cherish not only answering every question, but also being quick-witted. The answer has to be produced in the shortest amount of time with the...

Read More

I Keep Coming Back to One Question

“We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important to ensure survival under negative...

Read More

Mitigating Damage without Placing a Trade

“We will all feel pain in the next recession or stock market drop, but what can we do now to mitigate the damage?” – Pure...

Read More

Does Your ESG Approach Pass the Smell Test?

I was perusing my LinkedIn feed when a particular post caught my eye. For the record, I have no clue who Mark A. Smith is....

Read More

Municipal Magic

“You can take advantage of pockets of opportunity in what people don’t want.” – Jeff Gundlach, DoubleLine CEO We’ve been fielding a decent number of...

Read More

Waking up After a Yearlong Coma

“Every once in a while, the market does something so stupid it takes your breath away.” – Jim Cramer The date is April 29th, 2019....

Read More

The Plight of an All-Equity Investor

“The stock market is the story of cycles and of the human behaviour that is responsible for overreactions in both directions.” – Seth Klarman, CEO...

Read More

What’s Your Silver Lining?

The days blend together. I feel like Bill Murray in the movie Groundhog Day. I’m working at my makeshift office at the end of the...

Read More

Bear Market Rally or Did We Hit Bottom?

“A cycle like this does not end with a mere month-long correction. A real bear market is only over when no one is interested in...

Read More

Bear Market Assessment: What We Got Right & Wrong

Lawrence Hamtil runs a wealth management firm in Overland, KS. He posted the above self-assessment on Twitter on his portfolio positioning prior to the COVID-19...

Read More

Some Things Will Never be the Same

“Sometimes it’s the bad things that happen to us that become the catalyst for the good things to happen to us. Life forces you into...

Read More

Where Do We Go From Here?

“There’s clearly an indication that a systematic government-led approach using all tactics and all elements available seems to be able to turn this disease around.”...

Read More

Bear Market Blind Spots

“History reminds us the event that often derails financial markets is seldom the one investors saw coming.” – Pure Portfolios 2019 Year-end Commentary The past...

Read More

The Market is Talking. Are You Listening?

“It’s OK to not have an opinion on topics you don’t know anything about. And I don’t know anything about coronaviruses. But I have a...

Read More

What’s Your Process for Making Portfolio Changes?

“To get something done a committee should consist of no more than three people, two of whom are absent.” – Robert Copeland, U.S. Navy Admiral...

Read More

Are Low Yields a Good Reason to Shun Bonds?

“I don’t get why anyone would buy a 10-year bond yielding 1.5%” – Former Colleague Low bond yields are the new normal. It’s enough to...

Read More

How to Tell if your 401(k) Plan is Hot Garbage

We are conditioned to sock away money for retirement ASAP. You should save at least 10% of your income. By the time you’re 30, you...

Read More

Random $#%&

“No matter how sophisticated our choices, how good we are at dominating the odds, randomness will have the last word.” – Nassim Nicholas Taleb, Fooled...

Read More

The Amazing Run of U.S. Tech Stocks

Friend: “I need to buy more QQQ.” Later that day, while on a call… “Tech stocks make me nervous. I fear a repeat of the...

Read More

Do You Have an Information Filter?

“Thirty years ago the best investors had the biggest funnels of information. Today the best investors have the best filters of information. The market is...

Read More

Want Dividend Yield? Here’s Where to Look…

“As far as dividend yields go, the UK, Italy, Spain, and Singapore all offer dividend yields north of 4%, while US markets have the lowest...

Read More

What Does the SECURE Act Mean for You?

On December 20th, 2019, President Trump signed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act). The SECURE Act, effective January 1, 2020,...

Read More

Pure Portfolios 2020 Client Letter

It seems like yesterday that we left the corporate suits behind to launch Pure Portfolios. We are forever grateful to the clients that took the...

Read More

Pure Portfolios’ Best of 2019

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very...

Read More

Tis the Season for Wall Street Forecasting Pt. III

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” – Lao Tzu The annual charade of Wall Street sages predicting what will...

Read More

Did Investors Experience a Golden Decade?

If 2000-2009 was the “lost decade” for U.S. equity markets, 2010-2019 might be dubbed the blissful Goldilocks decade. But just how good was it? In...

Read More

It’s Time to Dump the Broken Risk Questionnaire

What would you do if your investment lost 20%? A) Buy more B) Sell C) Do nothing You’ve probably seen or taken a risk tolerance...

Read More

Portfolio Lay-Ups for Year-End

“Some taxpayers close their eyes, some stop their ears, some shut their mouths, but all pay through the nose.” – Evan Esar, American Humorist Thanksgiving...

Read More

What to Make of the “Election Uncertainty” Talk?

“To be absolutely certain about something, one must know everything or nothing about it.” – Henry Kissinger I can’t go one day without reading or...

Read More

What’s Your Different Kind of Wealth?

“That man is richest whose pleasures are cheapest.” – Henry David Thoreau Most people associate wealth with large bank accounts, extravagant homes, and luxury cars....

Read More

“I’ll Just Buy Amazon Stock”

I was sipping on a watered-down passion fruit iced tea waiting for my 1 o’clock to arrive. I had never met the person face to...

Read More

Your Wealth Manager Just Posted Record Profit Margins

“Your margin is my opportunity.” – Jeff Bezos, Amazon It was a dreary fall evening. It must have been a Tuesday or Wednesday because there...

Read More

Can High Dividend Stocks Replace Paltry Bond Income?

“We should target high dividend payers because bond yields are offering nothing.” – Random investors everywhere. U.S. bond yields have plummeted in 2019 reigniting a...

Read More

What is the Impact of Retiring in a High-Income Tax State?

Much goes into crafting a detailed retirement plan. We account for income, expenses, unexpected healthcare events, annual home maintenance, travel, etc. A good plan gets...

Read More

Could the 2020 Election Derail the Stock Market?

Everywhere we turn people are convinced the presidential election adds a layer of uncertainty to the financial markets. Depending on your politics, the election could...

Read More

Predicting the Next Recession

If we tracked the most commonly asked client question over the past six months, a variation of “when is the next big recession coming?” would...

Read More

Are you Paying for Services NOT Rendered?

You have a huge landscaping project in front of you. While you’ve done some basic lawn care in the past, this project will require the...

Read More

Should I Just Buy the S&P 500 in Retirement?

We were sitting outside on a beautiful late summer Portland day. I was having a spirited conversation with a retired prospective client who was working...

Read More

Is Anyone Bullish on the Stock Market?

We shared a laugh about how easy it was to come up with a list of potential landmines for the financial markets. The conversation was...

Read More

Should you Act on Big Down Market Days?

“Well, that escalated quickly.” – Ron Burgundy, Anchorman It should be obvious by now that presidential tweets are untradable, unpredictable, and financial markets are paying...

Read More

Simple Doesn’t Sell

“Complexity gives a comforting impression of control, while simplicity is hard to distinguish from cluelessness.” – Morgan Housel, The Collaborative Fund As financial markets flare...

Read More

Is Your Wealth Manager Overweight Equities?

“Pay attention to what they do, not what they say.” – Anonymous I was perusing a research note from another financial institution on their portfolio...

Read More

How Common are 5+% Pullbacks?

A client asked me what our crystal ball was saying after the turmoil this week. It’s impossible to know what happens next, but it did...

Read More

How I’m Personally Invested

I give people advice about what to do with their money. Therefore, you have a right to know how I personally invest, and my attitude...

Read More

All-Time High Retirement

The year was 2007. Bob had been with the same company for 30 years. He had diligently saved throughout his career, paid off his house,...

Read More

Fool Me Once, Fool Me A Billion Times

“You don’t have to be the biggest to beat the biggest.” – Ross Perot Raymond owns a small independent advisory firm (RIA) in the Portland...

Read More

The Fed’s About-Face

Just a year ago, the consensus was for the Federal Reserve to methodically increase interest rates to “normal” levels. As of this writing (7/9/2019), the...

Read More

The Most Interesting Charts in the World

Our inbox is bursting with mid-year reviews, commentary, and predictions for the rest of the year. The blitz of content ranges from thought provoking to...

Read More

The Unspoken Costs of a Doomsdayer

My Uncle Joe is absolutely convinced the market is going to crash. He’ll seek me out at family gatherings and say things like; “Washington is...

Read More

Fee Schedule Trickery

“Everything should be made as simple as possible, but no simpler.” Albert Einstein The further removed we get from the traditional wealth management machine, the...

Read More

Should You Only Own U.S. Stocks?

Many U.S. based investors believe so. In the investment universe, “Home Bias” is a term used to describe the tendency to own a heavy allocation...

Read More

Citywire Q&A with Nik Schuurmans

Pure Portfolios was recently featured in Citywire’s RIA “My Model Portfolio” series that ran in May’s print version and is live online (soft wall). Citywire...

Read More

So Much for Rising Rates

The cycle ended with hardly a peep, but it looks like the Fed is done increasing rates. Source: YCharts The above graph shows the initial...

Read More

Better Decisions with Sound Financial Planning

I used to have a healthy disdain for financial planning. I viewed it as data entry; type numbers into a software program and generate a...

Read More

Does your Portfolio Make the Grade?

“I already have a financial advisor managing my money.” That’s a good thing, right? Depends on the advisor. It can be dangerous to assume your...

Read More

Millennial Advice from a Millennial

The millennial generation is defined to those born between 1981-1996. In other words, if you’re between 22-37, you’re a millennial (I’m 37). Like every preceding...

Read More

Stability Breeds Instability

“Trump will fire off a tweet and tank the economy.” “The yield curve inversion all but guarantees a recession is right around the corner.” “Tariffs...

Read More

Do You Need a Trust?

People set up Trusts to minimize estate taxes, avoid probate, and seamlessly transfer assets to their heirs. Simply put, a Trust is a legal arrangement...

Read More

The One-Page Challenge

According to a 2018 Cerulli study, 42% of investors either believe their financial advice is free or they have no clue how much they pay....

Read More

Calling it off with 5-2 Offsuit

You’re mentally exhausted. It’s getting late and you’re on the tail end of a 12-hour marathon poker session. You’re down for the evening and desperately...

Read More

Mr. Bond and Mr. Market

Mr. Bond has been in a dark place. He’s back on the bottle, hasn’t showered in days, and has been sleeping in a dumpster. Mr....

Read More

Ultimate Transparency

Free from pretense or deceit Easily detected or seen through Readily understood Characterized by visibility or accessibility of information especially concerning business practices Source: Merriam-Webster...

Read More

What I’ve Learned Over My 15 Year Career

We started every day the same. Our team of “financial planners” gathered in a vast conference room with a sprawling white board at the front....

Read More

BBB Rated Movie

“U.S. corporate debt has climbed to roughly 46% of gross domestic product, the highest on record” – Rachel Louise Ensign, Wall Street Journal We wrote...

Read More

How to Punt Stacks of Cash to Uncle Sam

“The collection of taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare, is only a species of...

Read More

Let’s Talk Stock Buybacks

“I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.” – Charlie Munger...

Read More

Trend is Your Friend, An Alternative to Buy & Hold

“We’ve extended the analysis to every asset class where we could get our hands on the numbers and investigated the results. Same conclusion: trend-following minimizes...

Read More

Mutual Fund Owners, Check Your 1099s

“It’s really hard to make an argument for mutual funds in a taxable investment account.” – Meb Faber, Cambria Funds It’s easy to rail against...

Read More

Weirdness without Parallel

One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.” –...

Read More

The Best of Bogle

“I will create value for society, rather than extract it.” John C. Bogle, Founder of The Vanguard Group On April 13, 2004 John C. Bogle,...

Read More

The Most Dangerous Thing II

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.” – Jason Zweig, Author & WSJ Contributor. Back in...

Read More

2018: No Place to Hide

“There’s always a bull market somewhere” – Jim Cramer, CNBC Mad Money This marks the first and last time we quote Jim Cramer. He spews...

Read More

Take the Low-Hanging Fruit

The market carnage to close out 2018 carries an important reminder. Investing is hard. Performance comes and goes. The last nine years of easy money...

Read More

Tis the Season for Wall St. Forecasting Pt. II

“Never make predictions, especially about the future.” – Casey Stengel, Legendary Baseball Manager. This might be my favorite topic to write about. In fact, it’s...

Read More

Don’t Be Afraid of the ‘R’ Word

“Fear, greed, and hope have destroyed more portfolio value than any recession or depression we have ever been through.” – Jim O’Shaughnessy, Financial Author &...

Read More

Let’s Talk Yield Curve Inversion

Picture a veteran stock broker roaming the halls of a investment advisory firm. His shirt is stained with coffee. From the look of his wrinkled suit it...

Read More

Is the Santa Claus Rally Real?

I know a financial advisor who loves to talk about the Santa Claus rally every December. He has an outstanding mustache year-round (not just in...

Read More

Planning for the Ugly

“Telling people to “ignore the noise” or “think for the long-term” does not help in the moment unless you’ve set realistic expectations ahead of time....

Read More

The Most Dangerous Thing

“All other creatures use their intelligence to survive. We use ours to destroy ourselves.” – Marty Rubin, Author We worry about stock market bubbles, rising bond yields,...

Read More

No Hunt for Red October

In the 1990 war thriller “The Hunt for Red October” Sean Connery plays the role of Marko Ramius, a Soviet Union submarine captain who plans to defect. ...

Read More

Being Told to “Stay the Course”

“Volatility in the up direction is not a problem, it’s only downward volatility that offers discourse.” – Coreen T. Sol, Financial Author. Buy and hold...

Read More

Back to Back Negative Return Years for Bonds

“Bonds as an asset class will always be needed, and not just by insurance companies and pension funds, but by aging boomers.” – Bill Gross,...

Read More

Stock Returns in Midterm Election Years

“The real players in the global economy are consumers and producers (business). Politicians and regulators are similar to referees, which can influence short term ebbs and flows, but...

Read More

The Best Question You Could Ask

“People ask me my forecast for the economy when they should be asking me what I have in my portfolio. Don’t make pronouncements on what...

Read More

Investor Anxiety: Signs You’re Invested Incorrectly

“A reasonable-level of anxiety is a sign that you take investing seriously and are on guard against complacency and overconfidence. Meanwhile, too much anxiety is...

Read More

Persistence of Performance

“This year’s top-performing mutual funds aren’t necessarily going to be next year’s best performers. It’s not uncommon for a fund to have better-than-average performance one...

Read More

Fed Hikes and Bond Prosperity

“The Federal Open Market Committee (FOMC) has considerable control over short-term rates. We have much less influence over long-term rates, which are set in the...

Read More

U.S. and Everyone Else

“Emerging market economies have long grappled with the challenges posed by large and volatile cross-border capital flows.” – Jerome Powell, Chairman of the Federal Reserve....

Read More

Solving the Social Security Equation

“Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party...

Read More

Fees Tied to Performance is Gaining Momentum

“The investment industry has long offered clients fees that have nothing to do with performance. That’s changing, but not nearly fast enough.” – Jason Zweig,...

Read More

Is Your Asset Location Costing You?

“You must pay taxes. But there’s no law that says you gotta leave a tip.” – Morgan Stanley Most investors are familiar with the basic...

Read More

Ignoring Good Advice

“Small, seemingly insignificant steps completed consistently over time will create a radical difference.” – Darren Hardy, author of The Compound Effect Working with friends and family...

Read More

The Housing Cycle

“Housing is often found at the heart of financial crises”– Fed Chair, Jay Powell summer of 2017 We are not experts on residential housing by...

Read More

When it’s Broken, Don’t Fix it

“The most important thing you can have is a good strategic asset allocation mix. So, what the investor needs to do is have a balanced,...

Read More

The New S&P 500

We recently came across a do-it-yourself (DIY) investor, let’s call him Cecil. Cecil firmly proclaims he hates technology stocks and doesn’t feel comfortable owning Tesla, Facebook, Apple,...

Read More

Q2: Risk On?

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”– Peter Lynch,...

Read More

Sucker Dividend Yields

“One thing everyone should know about dividend yield is this: it doesn’t tell you much. It doesn’t give you clues about the valuation of a...

Read More

“How Often Do You Look at My Portfolio?”

“I was going to be a sales person representing that I managed the portfolio. I couldn’t live with that.” – Former Portfolio Manager at a...

Read More

Cash is a Weapon

“Hold some cash in reserve to take advantage of future opportunities.”– Seth Klarman, author of Margin of Safety. An underrated joy of writing our blog...

Read More

Loose Bubble Talk

“I’m hard-pressed to recall when any sort of bubble was accurately identified in real-time on the cover of a major media publication. If anything, the...

Read More

Beware of the Lazy 60/40

“A traditional static indexing approach leaves an investor overweight the riskiest assets at the riskiest times and underweight those low risk assets when their returns...

Read More

Unwinding a Variable Annuity

“Variable annuities are the cigarettes of the investment world, which has hidden its curse for decades.” – Ken Fisher, Fisher Investments. I keep a fluid...

Read More

Turning Safe Into Risky

“The more expensive debt becomes, the less weak corporations will be able to maintain the illusion of health.” Trevor Noren, 13D Research There seems to...

Read More

Less Obvious Mistakes

“Getting rich is one thing. Staying rich is quite another.” – Morgan Housel, The Collaborative Fund We are often asked a variation of “what are...

Read More

Hedge Fund Hold Up

The return of market volatility has increased the interest in alternative asset classes. A quick rundown of Barron’s You Make the Call publication shows private...

Read More

Sell in May and Go Away

They’ve done studies, you know. 60% of the time, it works every time.”– Brian Fantana, Anchorman: The Legend of Ron Burgundy. Profit seeking investors are...

Read More

Portfolio Audit

We hunt the internet for the best value. We read online reviews before making a purchase decision. We compare the leading brand with a less...

Read More

8 Signs Your Family Will Fight Over Your Estate

This is a guest post from our estate planning partner Everplans. In our effort to provide value beyond investment management, we will occasionally feature content from...

Read More

Q1 in Pics: The Dust Settles

“The S&P 500 hasn’t seen a down quarter since Q3 2015. The S&P has also seen positive returns in 19 out of the past 20...

Read More

My Advisor Doesn’t Charge Me a Fee

I’ve heard a variation of the above statement five times within the last year. I’ve had enough. You know the saying, if it’s too good...

Read More

The Mystic of Rising Interest Rates

“Nobody likes high interest rates.” – Chanda Kochhar, CEO of ICICI Bank Interest rate prognostications have taken on a life of their own. Like a...

Read More

Decoding Your Brokerage Statement

“Your brokerage statements suck” – Barry Glassman, Glassman Wealth The way we consume information has been turned upside down with the internet, smartphones, social media,...

Read More

Want More Yield On Cash?

The most common question we have received in the past nine years goes something like this; “How can I generate more interest on cash?” Up...

Read More

Tariff Gamesmanship?

On March 1, 2018 President Trump unexpectedly announced tariffs on imported steel and aluminum. The threat of a global trade war sent the S&P 500...

Read More

Gems from Buffett’s 2017 Letter

“There are three ways to go broke: “ladies, liquor and leverage”– Warren Buffett, quoting Charlie Munger during a recent CNBC interview. Warren Buffett recently penned...

Read More

Back to Normal

“If you believe markets are mean-reverting, higher returns and lower volatility today may equal the opposite in the future. We will enjoy the quiet while...

Read More

International Developed: What Do You Own?

“Gold jacket, green jacket…who gives a $%&!”– Happy Gilmore We have heard them called foreign equities, global markets, international developed, emerging markets, frontier markets, BRIC...

Read More

Warm & Fuzzy Financial Services Ads

I watch quite a bit of golf in my spare time. PGA Tour, Champions Tour, Korn Ferry, LPGA, it doesn’t matter. Watching top pros compete...

Read More

What’s Attractive in this Environment?

Looking back at 2017, the resounding theme from our clients has been disbelief around the perplexing nature of the runaway U.S. equity markets. However, most are quite...

Read More

Over-Diversification

“Your portfolio is a bowl of soup of random investments, seemingly cobbled together over time.” Meb Faber, Cambria Investments We review outside investment statements quite...

Read More

Why Clients Fire their Advisor

Change is hard. Humans like patterns, routines, and familiarity. This is especially true when dealing with sensitive issues like financial affairs. We rely on people...

Read More

What Happens After a +25% Year?

I have an evening routine of perusing Twitter for market research nuggets. I email myself interesting articles to read the following morning. I’m not looking...

Read More

What’s All This Volatility Talk?